The quick-term condo (STR) sector used to be as soon as the pandemic-era darling—providing privateness, protection and house when vacationers wanted it maximum. However now, because the mud settles, its position within the accommodation panorama is much less confident.

Utilization amongst United States recreational vacationers has plateaued at round one quarter of the marketplace since 2020, consistent with Phocuswright’s fresh record: U.S. Brief-Time period Leases 2025: Visitor Attitudes and Resolution Making. That balance would possibly seem promising, nevertheless it additionally mask a deeper factor: stagnation.

Whilst Airbnb continues to publish sturdy income, the class general is grappling with reputational drag fueled by way of viral headlines, asymmetric visitor reports and emerging scrutiny from the following technology of vacationers.

Subscribe to our publication underneath

“Whilst condo visitors specific prime delight charges with fresh remains—85% rated it a 4 or 5 on a scale the place 5 represents general delight, on par with their fresh resort remains—they aren’t unswerving to the class solely,” mentioned Madeline Listing, writer of the record and supervisor of study and particular initiatives for Phocuswright.

“Along with their STR remains, 68% of condo visitors additionally stayed in a resort and 18% in a lodge. Those vacationers are extremely cognizant of resort requirements and evaluate the 2 varieties of lodging in each buying groceries processes and the remains themselves.”

More youthful visitors—the ones below 35—are appearing indicators of skepticism. They are much less prone to see STRs as providing the most productive general keep they usually’re extra delicate to unfavourable press. They are additionally much less satisfied that leases ship actual worth for cash, regardless of the class’s benefits in house, facilities and versatility. If those perceptions persist, long run enlargement is in danger.

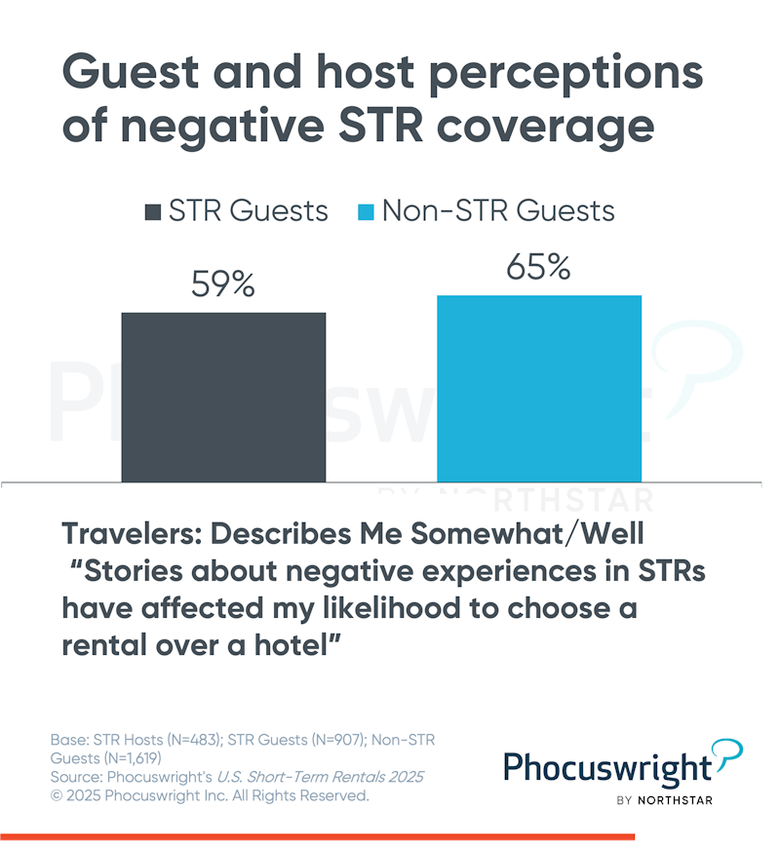

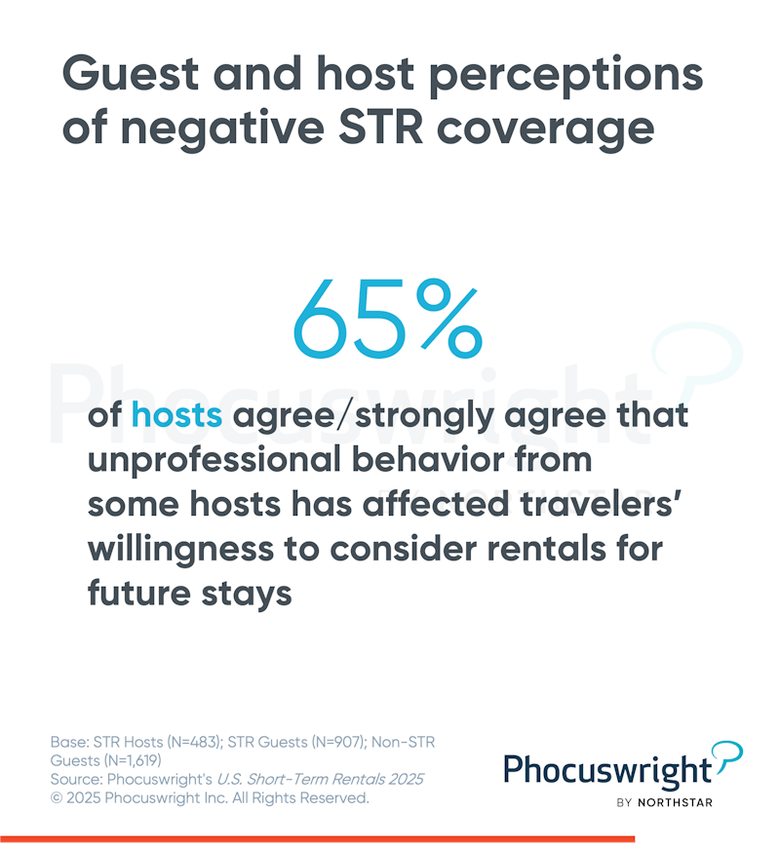

On the similar time, hosts themselves acknowledge the issue. A majority agree that unprofessional conduct around the sector is eroding shopper accept as true with. And when just about two thirds of visitors—without reference to whether or not they’ve stayed in a condo just lately—say that unfavourable tales have impacted their decision-making, the message is apparent: Public belief issues up to product supply.

“As visitor expectancies proceed emerging to reflect the ones of accommodations, many belongings managers (PM) be expecting to look a fallout within the aggressive scene,” Listing mentioned. “Houses that cling themselves to the very best requirements are anticipated to win extra visitors, particularly in a marketplace saturated with condo stock. Those that can not upward thrust to the problem are at higher possibility of economic failure and exiting the marketplace.

“However one of the hosts who’re much more likely to note the emerging expectancies also are those that combat with different spaces in their trade. Those come with hosts who don’t seem to be aiming to take advantage of their STR trade and people who have outsourced control to a PM.”

The STR trade isn’t simply maturing—it’s below power to conform. Transparency, consistency and recognition control are now not non-compulsory; they’re the levers of long run relevance. In a crowded market, the facility to form belief could also be simply as vital as what you construct at the back of the entrance door.

“A strong portion of recreational vacationers are staying in leases lately, although their frequency of class utilization and quantity spent on those lodging can have fluctuated,” Listing mentioned. “The majority of vacationers who use leases had been happy with their fresh remains, however important problems persist that may want to be addressed to ensure that STRs to make additional inroads on accommodations.”

Phocuswright’s U.S. Brief-Time period Leases 2025: Visitor Attitudes and Resolution Making