The publish Visa items its 2025 Cash Travels remittances file for the Asia-Pacific gave the impression first on TD (Commute Day-to-day Media) Commute Day-to-day Media.

International virtual bills platform Visa introduced the result of its annual Cash Travels: 2025 Virtual Remittances Adoption File on Wednesday, thirteenth August.

The file is according to responses from 44,000 senders and receivers throughout 20 international locations and territories, monitoring remittance tendencies around the globe, together with Asia Pacific, a key area within the $905 billion international remittance panorama.

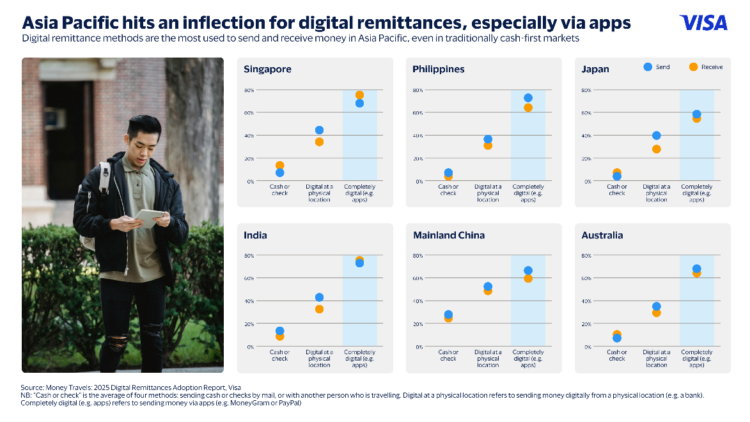

Key findings on this yr’s survey display virtual packages as the most well liked way for sending and receiving remittances, and simplicity of use, protection, privateness, and safety as the highest 4 consumer revel in advantages riding such choice.

In keeping with Visa’s senior vice-president and head of business and cash motion answers within the Asia-Pacific Chavi Jafa: “Remittances have lengthy pushed expansion throughout Asia Pacific, uplifting many economies within the area. The transparent shift to app-based remittances displays the area’s demographics, the rising prominence of virtual cost modes, in addition to consumer personal tastes for simple, protected and fast tactics to ship and obtain cash. This shift is the most important one for banks, remitters and fintechs to notice as it’s going to form how they have interaction and serve evolving shopper expectancies.”

Key findings for the Asia-Pacific

Virtual apps stay the most well liked and are perceived because the quickest possibility

- Virtual apps are essentially the most most popular channel to ship/obtain remittances in Asia Pacific, with utilization charges attaining its best possible in India (74%/76%), the Philippines (74%/66%), and Singapore (70%/75%).

- Japan may be seeing stable expansion, with virtual app utilization emerging through 10% (58%/56%) in 2025 in comparison to the former yr.

- Over part of the respondents within the Philippines (73%/73%), Australia (58%/55%), Singapore (67%/66%), and India (55%/53%) understand virtual bills because the quickest approach to get admission to price range (73%).

- Maximum Asia Pacific remittance customers surveyed file experiencing no problems with sending/receiving virtual remittance transfers throughout all Asian markets, maximum undoubtedly in Australia (48%/53%), Japan (37%/41%), Singapore (36%/37%), and Mainland China (38%/31%, emerging considerably since 2024 at +13%/+8%).

Remittance rationale varies around the area

- Contributing to accounts/investments is a number one reason why to ship/obtain remittances throughout a number of markets together with Mainland China (45%/36%), Singapore (38%/33%), and Japan (27%/23%).

- Sending for normal/particular humanitarian want is a key reason why for remittances, cited through respondents in Mainland China (45%/33%), India (40%), Singapore (27%), and Australia (25%).

- Sending remittances for an sudden want was once best possible in India (44%), the Philippines (41%), and Australia (31%).

- Receiving common remittances was once cited through roughly a 3rd of respondents within the Philippines (39%), Mainland China (34%), and India (30%).

Safety and comfort outweigh ache issues comparable to charges

- Virtual apps are considered as essentially the most protected approach to ship/obtain remittances in Asia Pacific, with best responses from India (50%/53%), Australia (49%/45%), and Singapore (44%/42%).

- Ease of use to ship/obtain virtual remittances was once famous maximum through respondents in Singapore (51%/51%) the Philippines (48%/54%), Japan (47%/42%), and Australia (42%/40%).

- Virtual app charges for sending/receiving remittances have been highlighted as a best ache level throughout Asia Pacific, led through the Philippines (43%/30%), India (36%/33%), and Singapore (32%/32%).

- In a similar way, prime charges have been famous as the highest ache level for sending bodily remittances throughout all markets, with best responses from the Philippines (45%/29%), India (41%/37%), Singapore (38%/30%), Australia (29%/30%).

- Inconvenience and lengthy shuttle distances stay key demanding situations for sending bodily remittances, with respondents in India (36%) and Mainland China (27%) mentioning shuttle as a barrier. In Australia and Singapore, 29% of respondents every famous the bodily remittance procedure as inconvenient and time-consuming along issues about prime charges.

- Throughout maximum Asia Pacific international locations surveyed, the perceived safety of bodily remittances was once low (3%-6%), with Mainland China reporting quite upper ranges of self assurance (10%-12%).

A wish to repeatedly innovate

With 1000000000 other folks depending annually on remittance products and services and platforms, Visa continues to innovate and construct answers to allow bills companies to make stronger operational potency in cash motion and increase monetary get admission to for his or her consumers.

Rhidoi Krishnakumar, vice-president and head of Visa Direct within the Asia-Pacific, stated: “Remittances have lengthy been a lifeline throughout Asia Pacific, and they’ll proceed to play a very important position in uplifting communities and livelihoods. On the similar time, many small companies also are beneficiaries of remittances riding native expansion in native economies.”

Visa recognises the long-lasting goal of our position in turning in remittances on behalf of its purchasers and continues to innovate and construct answers to allow extra environment friendly, dependable and protected tactics to transport cash.

With that during thoughts, Visa works in collaboration with international remitters, comparable to MOIN, WireBarley, Cash Chain Global Remittance and EzRemit, to lend a hand allow environment friendly cash motion thru digitised remittances.

The publish Visa items its 2025 Cash Travels remittances file for the Asia-Pacific gave the impression first on Commute Day-to-day Media.