India has been a cash-dominant society for many years. The explanations bodily forex continued lengthy after different economies had digitized hint again to infrastructure gaps, restricted web get right of entry to and deep-seated consider problems.

Till the mid-2010s, just about part the inhabitants lacked a checking account or any reliable type of id, making coins the one universally authorized comfortable. When plastic cash arrived, uptake used to be low and bank cards remained area of interest; not up to 4% of adults held one in 2024. And debit playing cards, regardless that issued within the masses of tens of millions, functioned principally as keys to ATMs reasonably than as equipment for trade.

Cardholders confronted an inordinate quantity of friction: Newly issued playing cards had been disabled for on-line or contactless use through default; checkout required second-factor authentication (2FA) along with the 16-digit card quantity and CVV, all on frequently slow financial institution pages; and each and every mistyped digit or behind schedule SMS intended a failed fee. Upload patchy service provider acceptance, well-liked worry of fraud and a cultural aversion to debt into the combination, and India’s consumers saved opting for the tactile sure bet of money.

Subscribe to our publication underneath

Ahead of fintech’s giant bang, India’s on-line customers muddled thru web banking—guide NEFT/IMPS transfers, payee registration and clunky financial institution portals that simplest tech-savvy customers tolerated. The true spark got here when cellular wallets burst onto telephones within the early- to mid-2010s.

Paytm, FreeCharge and Mobikwik grew to become a recharge app right into a pocket-sized handbag: Load coins as soon as, faucet to pay, cut up a invoice or reward cash in seconds with out a OTP marathons or detailed card data to offer. Cashback gives, QR codes at each and every tea stall and quick peer-to-peer (P2P) transfers pulled tens of tens of millions into their first virtual transactions.

But every pockets used to be a walled lawn; price range couldn’t freely hop between apps or again to financial institution accounts. Whilst cellular wallets demonstrated that Indians had been in a position for cash-free comfort, in addition they printed that the rustic wanted an open, interoperable channel to complete the process.

Implications for the journey trade

India’s journey trade rode the similar virtual fee wave that reshaped retail, however its inflection level arrived later—and with sharper penalties. Shuttle merchandise call for complete, irrevocable fee ahead of issuance, so the sphere may now not lean on cash-on-delivery (COD) the best way e-commerce did. For years that unmarried constraint saved tens of millions of price-sensitive, cardless Indians in offline queues and on the mercy of price ticket brokers.

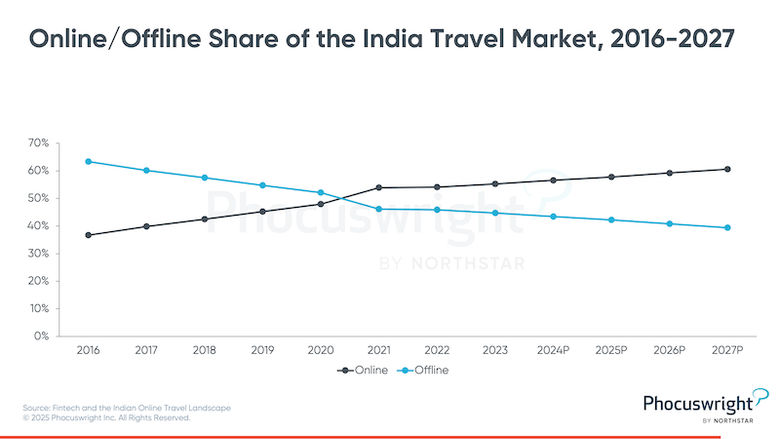

As successive fee strategies matured—from web banking to cellular wallets and in spite of everything to Unified Bills Interface (UPI)—every unlocked a larger slice of call for, accelerating the channel shift to on-line. The fad opened up along emerging virtual literacy, broader 4G/5G get right of entry to and upgraded, feature-packed reserving websites from main journey manufacturers and on-line journey companies (OTAs). In 2021, virtual bookings tipped previous the 50% threshold of general journey spend.

On-line journey enlargement past the metros

UPI’s unfold into India’s heartland is reshaping the buyer map for journey manufacturers. Proof is mounting that Tier-2 and Tier-3 citizens at the moment are reserving journey on cellular in huge numbers. Ixigo gives the clearest evidence: UPI is the most popular fee way for 80% of the OTA’s person base, and within the ultimate quarter of FY25 (January 1 to March 31), 93.9% of its bookings touched a minimum of one non-Tier-1 town.

The journey trade in India has been an immediate beneficiary of the fintech and bills revolution. Fintech corporations with huge person bases have expanded into providing journey services and products, additional propelling on-line journey transactions. Now recent fintech answers are catching on temporarily national, laying the groundwork for the following surge in virtual journey enlargement.

In slightly a decade, fintech has flipped India’s journey marketplace from cash-and-agents to mobile-and-apps. UPI opened the door to self-service bookings for the hundreds, virtual wallets and journey superapps put complete journeys on a telephone display screen and add-ons like purchase now, pay later (BNPL) and risk-based ancillaries got rid of the dual hurdles of affordability and menace.

India’s subsequent travel-fintech jump is more likely to package a number of applied sciences immediately: embedded finance, during which non-financial services and products corporations, say Uber or WhatsApp, be offering bills capability to their trade shoppers; an upgraded UPI stack (mandates, RuPay credit score, One Global QR) and digital tools corresponding to single-use playing cards and even the Virtual Rupee.

Those and different inventions in bills, credit score and menace coverage will widen the runway for tens of millions of recent trips, making sure that the following bankruptcy of Indian journey might be written now not simply by planes and trains however through apps, a powerful economic framework and seamless fee rails.

Phocuswright’s Fintech and the Indian On-line Shuttle Panorama

UPI sits on the middle of the shift, changing coins for tens of millions and increasing on-line

reserving previous India’s Tier-1 metro spaces. Different equipment corresponding to BNPL are redefining affordability and extra. The following technology of journey enlargement in India has been unlocked.

India has been a cash-dominant society for many years. The explanations bodily forex continued lengthy after different economies had digitized hint again to infrastructure gaps, restricted web get right of entry to and deep-seated consider problems.

Till the mid-2010s, just about part the inhabitants lacked a checking account or any reliable type of id, making coins the one universally authorized comfortable. When plastic cash arrived, uptake used to be low and bank cards remained area of interest; not up to 4% of adults held one in 2024. And debit playing cards, regardless that issued within the masses of tens of millions, functioned principally as keys to ATMs reasonably than as equipment for trade.

Cardholders confronted an inordinate quantity of friction: Newly issued playing cards had been disabled for on-line or contactless use through default; checkout required second-factor authentication (2FA) along with the 16-digit card quantity and CVV, all on frequently slow financial institution pages; and each and every mistyped digit or behind schedule SMS intended a failed fee. Upload patchy service provider acceptance, well-liked worry of fraud and a cultural aversion to debt into the combination, and India’s consumers saved opting for the tactile sure bet of money.

Subscribe to our publication underneath

Ahead of fintech’s giant bang, India’s on-line customers muddled thru web banking—guide NEFT/IMPS transfers, payee registration and clunky financial institution portals that simplest tech-savvy customers tolerated. The true spark got here when cellular wallets burst onto telephones within the early- to mid-2010s.

Paytm, FreeCharge and Mobikwik grew to become a recharge app right into a pocket-sized handbag: Load coins as soon as, faucet to pay, cut up a invoice or reward cash in seconds with out a OTP marathons or detailed card data to offer. Cashback gives, QR codes at each and every tea stall and quick peer-to-peer (P2P) transfers pulled tens of tens of millions into their first virtual transactions.

But every pockets used to be a walled lawn; price range couldn’t freely hop between apps or again to financial institution accounts. Whilst cellular wallets demonstrated that Indians had been in a position for cash-free comfort, in addition they printed that the rustic wanted an open, interoperable channel to complete the process.

Implications for the journey trade

India’s journey trade rode the similar virtual fee wave that reshaped retail, however its inflection level arrived later—and with sharper penalties. Shuttle merchandise call for complete, irrevocable fee ahead of issuance, so the sphere may now not lean on cash-on-delivery (COD) the best way e-commerce did. For years that unmarried constraint saved tens of millions of price-sensitive, cardless Indians in offline queues and on the mercy of price ticket brokers.

As successive fee strategies matured—from web banking to cellular wallets and in spite of everything to Unified Bills Interface (UPI)—every unlocked a larger slice of call for, accelerating the channel shift to on-line. The fad opened up along emerging virtual literacy, broader 4G/5G get right of entry to and upgraded, feature-packed reserving websites from main journey manufacturers and on-line journey companies (OTAs). In 2021, virtual bookings tipped previous the 50% threshold of general journey spend.

On-line journey enlargement past the metros

UPI’s unfold into India’s heartland is reshaping the buyer map for journey manufacturers. Proof is mounting that Tier-2 and Tier-3 citizens at the moment are reserving journey on cellular in huge numbers. Ixigo gives the clearest evidence: UPI is the most popular fee way for 80% of the OTA’s person base, and within the ultimate quarter of FY25 (January 1 to March 31), 93.9% of its bookings touched a minimum of one non-Tier-1 town.

The journey trade in India has been an immediate beneficiary of the fintech and bills revolution. Fintech corporations with huge person bases have expanded into providing journey services and products, additional propelling on-line journey transactions. Now recent fintech answers are catching on temporarily national, laying the groundwork for the following surge in virtual journey enlargement.

In slightly a decade, fintech has flipped India’s journey marketplace from cash-and-agents to mobile-and-apps. UPI opened the door to self-service bookings for the hundreds, virtual wallets and journey superapps put complete journeys on a telephone display screen and add-ons like purchase now, pay later (BNPL) and risk-based ancillaries got rid of the dual hurdles of affordability and menace.

India’s subsequent travel-fintech jump is more likely to package a number of applied sciences immediately: embedded finance, during which non-financial services and products corporations, say Uber or WhatsApp, be offering bills capability to their trade shoppers; an upgraded UPI stack (mandates, RuPay credit score, One Global QR) and digital tools corresponding to single-use playing cards and even the Virtual Rupee.

Those and different inventions in bills, credit score and menace coverage will widen the runway for tens of millions of recent trips, making sure that the following bankruptcy of Indian journey might be written now not simply by planes and trains however through apps, a powerful economic framework and seamless fee rails.

Phocuswright’s Fintech and the Indian On-line Shuttle Panorama

UPI sits on the middle of the shift, changing coins for tens of millions and increasing on-line

reserving previous India’s Tier-1 metro spaces. Different equipment corresponding to BNPL are redefining affordability and extra. The following technology of journey enlargement in India has been unlocked.