As soon as the afterthought of the go back and forth trade, the excursions and actions sector has come a ways. The time for consolidation at the provide aspect has arrived.

Consolidation and brand-building are primary habitual issues in all industries, and surely throughout go back and forth. Why no longer in excursions and reports?

Marketplace stipulations warrant it. The field is very fragmented. There are masses of hundreds of excursion operators and enjoy suppliers, however they’re most commonly small companies. Barring a couple of multi-city hop-on/hop-off bus manufacturers (Town Sightseeing, Giant Bus Excursions) and the Grey Line licensing style, there are nearly no globally identified manufacturers.

A protracted tail of small operators

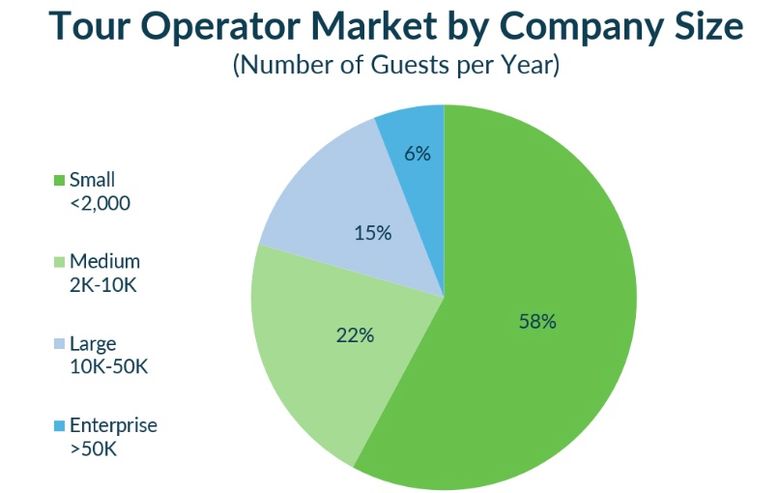

In Arival’s World Operator Panorama third Version, a survey of seven,000 enjoy operators international, nearly all of excursion operators are small or medium-size operations (in accordance with our groupings via reasonable collection of visitors served prior to now 12 months).

The excursions sector is huge however in large part unorganized. There are not any common service-level requirements, no hotel-style big name rankings and no same old working procedures. A unmarried seek for “the Colosseum” can yield over a thousand listings throughout on-line go back and forth businesses (OTAs) like Viator and GetYourGuide.

Subscribe to our publication underneath

Such fragmentation creates friction for shoppers and a variety of marketplace inefficiencies. There’s no scarcity of classes from different industries ruled via small companies: espresso stores (Starbucks), health and wellness (Planet Health, CrossFit, Therapeutic massage Envy), circle of relatives leisure facilities and so forth.

What’s preserving the field again?

So why hasn’t extra consolidation came about, particularly given the increasing trade enthusiasm for excursions and actions? It’s a fast-growing sector in tourism, and vacationers are an increasing number of making plans go back and forth round reports.

In spite of the joy over the upward push of reports, there are long-held assumptions which have been efficient investor deterrents:

- A protracted tail of small companies approach buyers must do a large number of offers to reach scale.

- Many operators are low-tech way of life companies (3 in 4, in keeping with our analysis), this means that a heavy operational elevate to modernize and combine with different operators.

- Limitations to access are low, particularly in asset-light excursion companies corresponding to strolling and meals excursions.

But regardless of those limitations, the previous decade has noticed a subset of operators modernize operations, undertake tech and thrive—environment the degree for the consolidation forward.

Excursions have come a ways

A lot of the excursions and actions sector is a ways in the back of the remainder of go back and forth in know-how and industry modernization. Alternatively, there’s a important subset of technology-forward operators which might be main the trade into the long run.

There may be scale on the best

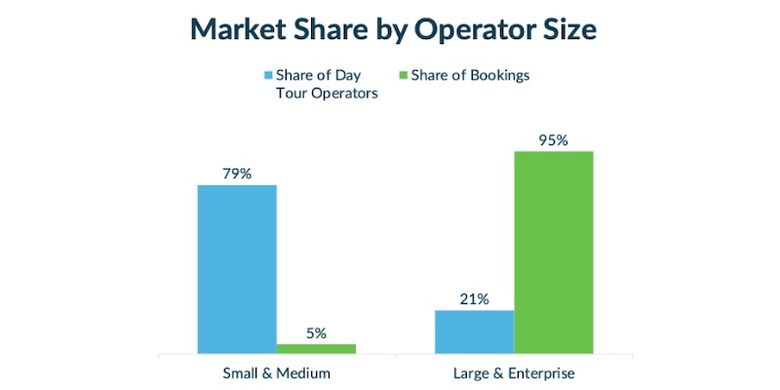

That smaller cohort of bigger operators—the ones dealing with a minimum of 10,000 visitors in step with 12 months (PAX), which constitute 21% of all operators, in step with the chart above—account for nearly all of sector earnings. Our modeling suggests they will account for up to 95% of all bookings.

The operators that subject are attached

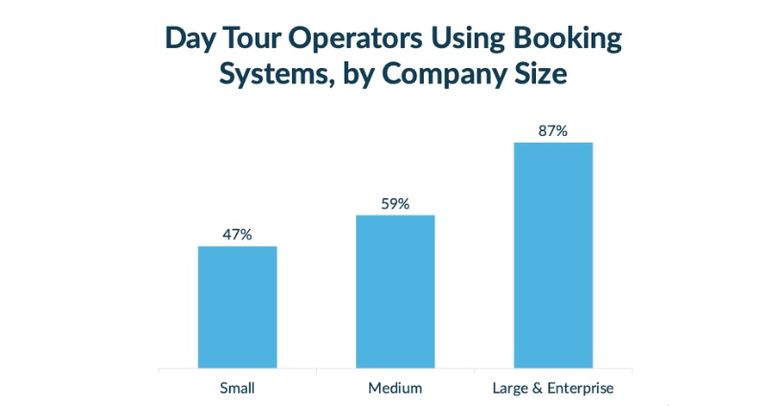

Whilst the excursions and actions sector is widely known for its gradual tempo of know-how adoption—two in 5 operators nonetheless don’t fashionable on-line reserving device to function their industry—the operators that transfer the marketplace are forward in tech.

The majority of better operators use reserving techniques, connect with OTAs by means of APIs and use various platforms to run their industry. Many operators want to enforce features corresponding to dynamic pricing.

Steadiness sheets are wholesome once more

There have been more than likely few industries extra brutalized via the pandemic than the excursions sector. Following greater than two years of almost no global tourism (upon which the excursions sector is especially reliant), the field is booming, particularly in Europe.

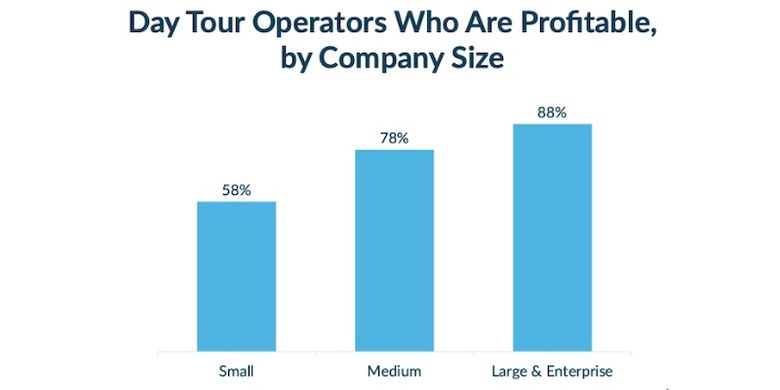

Steadiness sheets are wholesome, industry is cast and bigger operators specifically seem to be extra successful. Just about 9 in 10 reported profitability ultimate 12 months (as opposed to an trade reasonable of 65%), and so they additionally file upper charges of profitability.

Operational excellence is a will have to within the generation of reports

The excursions sector has low limitations to access. In different phrases, it’s well-known—or notorious—for the convenience with which new entrants can input a marketplace, be offering affordable excursions and get started a race to the ground. The field has no scarcity of fly-by-night operators of doubtful high quality and – in some instances – industry ethics.

However the marketplace is converting swiftly. Increasingly, vacationers are prioritizing excursions and reports of their go back and forth making plans. They’re reserving additional upfront, and so they be expecting pristine virtual reports and operational excellence.

On-line opinions make—or spoil—new excursions and reports. For plenty of operators, the standard in their excursion listings and the quantity of four- and five-star opinions throughout OTAs and different internet sites are key property.

Nowadays’s operators will have to have working excellence throughout advertising, excursion supply and useful resource control. Those who don’t can be outmaneuvered via those who do, from successful consumers and keeping guides to making sure profitability throughout all excursion departures.

What makes a goal for acquisition

Now not each and every operator could be a candidate. Certainly, maximum would no longer. Here’s a profile I’ve assembled in accordance with conversations with a variety of trade executives.

- Winning and increasing: Top single-digit to low double-digit enlargement

- Era-forward: The usage of fashionable reserving techniques, automation and attached distribution

- Robust property: Direct reserving energy, high-performing OTA listings or dominant positioning in key locations

- Native leverage: Established relationships with customer points of interest, vacation spot advertising organizations and different key companions within the native marketplace

- Operational excellence: Professional information networks, scalable operations and constant product high quality.

One ultimate “cushy” high quality can be crucial: versatile homeowners and control. For a roll-up to paintings, economies of scale can be essential. The industry homeowners and executives who stick with the industry must be open to operational and cultural trade, continuously a troublesome tablet to swallow for owner-operators who’ve constructed a industry with their very own two palms.

This contemporary article from Oliver Mernick-Levene, CEO of Secret Meals Excursions, supplies an in depth walk-through of a up to date acquisition and covers what operators will have to be expecting all through and after the method.

What this implies for operators and the trade

A scaled, strategic roll-up of operators throughout key markets may just reach economies of scale throughout operations, advertising and distribution that would considerably trade the panorama for vacationers, operators and resellers.

- Alternatives for the best operators: Manufacturers with top of the range merchandise, scalable operations and defensible property is also high acquisition goals, getting access to capital, operational reinforce and broader distribution.

- Dangers for smaller operators: The ones with out differentiation might battle to compete as consolidation concentrates energy amongst extra environment friendly, technology-forward manufacturers.

- A brand new negotiating panorama with OTAs: A scaled operator may have new negotiating leverage with the huge resellers.

Taking a look forward: Will this in reality occur?

Fragmentation, asymmetric high quality and renewed monetary energy amongst main operators create a powerful case for consolidation. The present point of fragmentation and enjoy inconsistency is just no longer a excellent factor for shoppers. That’s why I be expecting, over the following couple of years, to peer strategic, long-term buyers achieve well-run operators, scale operations and develop into the panorama.

In regards to the creator…

As soon as the afterthought of the go back and forth trade, the excursions and actions sector has come a ways. The time for consolidation at the provide aspect has arrived.

Consolidation and brand-building are primary habitual issues in all industries, and surely throughout go back and forth. Why no longer in excursions and reports?

Marketplace stipulations warrant it. The field is very fragmented. There are masses of hundreds of excursion operators and enjoy suppliers, however they’re most commonly small companies. Barring a couple of multi-city hop-on/hop-off bus manufacturers (Town Sightseeing, Giant Bus Excursions) and the Grey Line licensing style, there are nearly no globally identified manufacturers.

A protracted tail of small operators

In Arival’s World Operator Panorama third Version, a survey of seven,000 enjoy operators international, nearly all of excursion operators are small or medium-size operations (in accordance with our groupings via reasonable collection of visitors served prior to now 12 months).

The excursions sector is huge however in large part unorganized. There are not any common service-level requirements, no hotel-style big name rankings and no same old working procedures. A unmarried seek for “the Colosseum” can yield over a thousand listings throughout on-line go back and forth businesses (OTAs) like Viator and GetYourGuide.

Subscribe to our publication underneath

Such fragmentation creates friction for shoppers and a variety of marketplace inefficiencies. There’s no scarcity of classes from different industries ruled via small companies: espresso stores (Starbucks), health and wellness (Planet Health, CrossFit, Therapeutic massage Envy), circle of relatives leisure facilities and so forth.

What’s preserving the field again?

So why hasn’t extra consolidation came about, particularly given the increasing trade enthusiasm for excursions and actions? It’s a fast-growing sector in tourism, and vacationers are an increasing number of making plans go back and forth round reports.

In spite of the joy over the upward push of reports, there are long-held assumptions which have been efficient investor deterrents:

- A protracted tail of small companies approach buyers must do a large number of offers to reach scale.

- Many operators are low-tech way of life companies (3 in 4, in keeping with our analysis), this means that a heavy operational elevate to modernize and combine with different operators.

- Limitations to access are low, particularly in asset-light excursion companies corresponding to strolling and meals excursions.

But regardless of those limitations, the previous decade has noticed a subset of operators modernize operations, undertake tech and thrive—environment the degree for the consolidation forward.

Excursions have come a ways

A lot of the excursions and actions sector is a ways in the back of the remainder of go back and forth in know-how and industry modernization. Alternatively, there’s a important subset of technology-forward operators which might be main the trade into the long run.

There may be scale on the best

That smaller cohort of bigger operators—the ones dealing with a minimum of 10,000 visitors in step with 12 months (PAX), which constitute 21% of all operators, in step with the chart above—account for nearly all of sector earnings. Our modeling suggests they will account for up to 95% of all bookings.

The operators that subject are attached

Whilst the excursions and actions sector is widely known for its gradual tempo of know-how adoption—two in 5 operators nonetheless don’t fashionable on-line reserving device to function their industry—the operators that transfer the marketplace are forward in tech.

The majority of better operators use reserving techniques, connect with OTAs by means of APIs and use various platforms to run their industry. Many operators want to enforce features corresponding to dynamic pricing.

Steadiness sheets are wholesome once more

There have been more than likely few industries extra brutalized via the pandemic than the excursions sector. Following greater than two years of almost no global tourism (upon which the excursions sector is especially reliant), the field is booming, particularly in Europe.

Steadiness sheets are wholesome, industry is cast and bigger operators specifically seem to be extra successful. Just about 9 in 10 reported profitability ultimate 12 months (as opposed to an trade reasonable of 65%), and so they additionally file upper charges of profitability.

Operational excellence is a will have to within the generation of reports

The excursions sector has low limitations to access. In different phrases, it’s well-known—or notorious—for the convenience with which new entrants can input a marketplace, be offering affordable excursions and get started a race to the ground. The field has no scarcity of fly-by-night operators of doubtful high quality and – in some instances – industry ethics.

However the marketplace is converting swiftly. Increasingly, vacationers are prioritizing excursions and reports of their go back and forth making plans. They’re reserving additional upfront, and so they be expecting pristine virtual reports and operational excellence.

On-line opinions make—or spoil—new excursions and reports. For plenty of operators, the standard in their excursion listings and the quantity of four- and five-star opinions throughout OTAs and different internet sites are key property.

Nowadays’s operators will have to have working excellence throughout advertising, excursion supply and useful resource control. Those who don’t can be outmaneuvered via those who do, from successful consumers and keeping guides to making sure profitability throughout all excursion departures.

What makes a goal for acquisition

Now not each and every operator could be a candidate. Certainly, maximum would no longer. Here’s a profile I’ve assembled in accordance with conversations with a variety of trade executives.

- Winning and increasing: Top single-digit to low double-digit enlargement

- Era-forward: The usage of fashionable reserving techniques, automation and attached distribution

- Robust property: Direct reserving energy, high-performing OTA listings or dominant positioning in key locations

- Native leverage: Established relationships with customer points of interest, vacation spot advertising organizations and different key companions within the native marketplace

- Operational excellence: Professional information networks, scalable operations and constant product high quality.

One ultimate “cushy” high quality can be crucial: versatile homeowners and control. For a roll-up to paintings, economies of scale can be essential. The industry homeowners and executives who stick with the industry must be open to operational and cultural trade, continuously a troublesome tablet to swallow for owner-operators who’ve constructed a industry with their very own two palms.

This contemporary article from Oliver Mernick-Levene, CEO of Secret Meals Excursions, supplies an in depth walk-through of a up to date acquisition and covers what operators will have to be expecting all through and after the method.

What this implies for operators and the trade

A scaled, strategic roll-up of operators throughout key markets may just reach economies of scale throughout operations, advertising and distribution that would considerably trade the panorama for vacationers, operators and resellers.

- Alternatives for the best operators: Manufacturers with top of the range merchandise, scalable operations and defensible property is also high acquisition goals, getting access to capital, operational reinforce and broader distribution.

- Dangers for smaller operators: The ones with out differentiation might battle to compete as consolidation concentrates energy amongst extra environment friendly, technology-forward manufacturers.

- A brand new negotiating panorama with OTAs: A scaled operator may have new negotiating leverage with the huge resellers.

Taking a look forward: Will this in reality occur?

Fragmentation, asymmetric high quality and renewed monetary energy amongst main operators create a powerful case for consolidation. The present point of fragmentation and enjoy inconsistency is just no longer a excellent factor for shoppers. That’s why I be expecting, over the following couple of years, to peer strategic, long-term buyers achieve well-run operators, scale operations and develop into the panorama.

In regards to the creator…