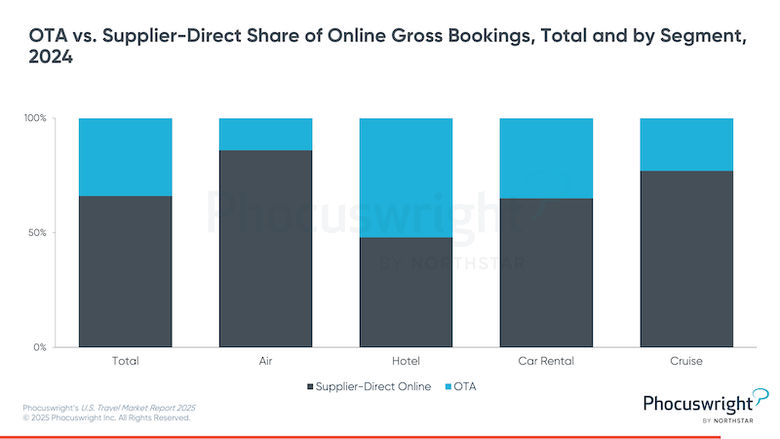

U.S. on-line commute companies posted $108.5 billion in gross bookings in 2024, up 4% from 2023 and 85% upper than 2019 ranges (apart from momentary leases). In line with Phocuswright’s U.S. On-line Shuttle Company Marketplace Necessities 2025, OTA marketplace proportion stays stable, with simplest slight channel shifts expected, akin to a marginal transfer towards supplier-direct air and resort bookings thru 2028.

Subscribe to our publication under

In contrast stable backdrop, 5 key developments are set to outline the following bankruptcy for U.S. OTAs.

B2B spice up continues: Expedia, Reserving and Hopper are increasing spouse networks and white-label offers—particularly in Asia—riding vital earnings expansion and new private-label commute services and products.

Upper yield thru loyalty: Unified platforms and more potent rewards are paying off, with Expedia and Reserving seeing document direct bookings from One Key and Genius individuals, reducing advertising and marketing prices and extending repeat remains.

The upward push of digital brokers: OTAs are embedding generative and agentic synthetic intelligence (AI)—like Priceline’s Penny—whilst partnering with main AI avid gamers to personalize seek, making plans and reserving.

Connecting the dots: Dynamic programs and attached travel methods are gaining traction, with packaged gross bookings up and projected to stay mountain climbing thru 2028.

As opposed to Airbnb: OTAs are differentiating and increasing deepest lodging, with Vrbo leaning into natural holiday leases and Reserving rising its selection accommodation combine to 37% of room nights.

Phocuswright Analysis’s U.S. On-line Shuttle Company Marketplace Necessities 2025

New in 2025, this Necessities document delivers top-level takeaways for the U.S OTA marketplace, that includes charts and research at the key developments, phase highlights and marketplace sizing datapoints that subject maximum.

U.S. on-line commute companies posted $108.5 billion in gross bookings in 2024, up 4% from 2023 and 85% upper than 2019 ranges (apart from momentary leases). In line with Phocuswright’s U.S. On-line Shuttle Company Marketplace Necessities 2025, OTA marketplace proportion stays stable, with simplest slight channel shifts expected, akin to a marginal transfer towards supplier-direct air and resort bookings thru 2028.

Subscribe to our publication under

In contrast stable backdrop, 5 key developments are set to outline the following bankruptcy for U.S. OTAs.

B2B spice up continues: Expedia, Reserving and Hopper are increasing spouse networks and white-label offers—particularly in Asia—riding vital earnings expansion and new private-label commute services and products.

Upper yield thru loyalty: Unified platforms and more potent rewards are paying off, with Expedia and Reserving seeing document direct bookings from One Key and Genius individuals, reducing advertising and marketing prices and extending repeat remains.

The upward push of digital brokers: OTAs are embedding generative and agentic synthetic intelligence (AI)—like Priceline’s Penny—whilst partnering with main AI avid gamers to personalize seek, making plans and reserving.

Connecting the dots: Dynamic programs and attached travel methods are gaining traction, with packaged gross bookings up and projected to stay mountain climbing thru 2028.

As opposed to Airbnb: OTAs are differentiating and increasing deepest lodging, with Vrbo leaning into natural holiday leases and Reserving rising its selection accommodation combine to 37% of room nights.

Phocuswright Analysis’s U.S. On-line Shuttle Company Marketplace Necessities 2025

New in 2025, this Necessities document delivers top-level takeaways for the U.S OTA marketplace, that includes charts and research at the key developments, phase highlights and marketplace sizing datapoints that subject maximum.