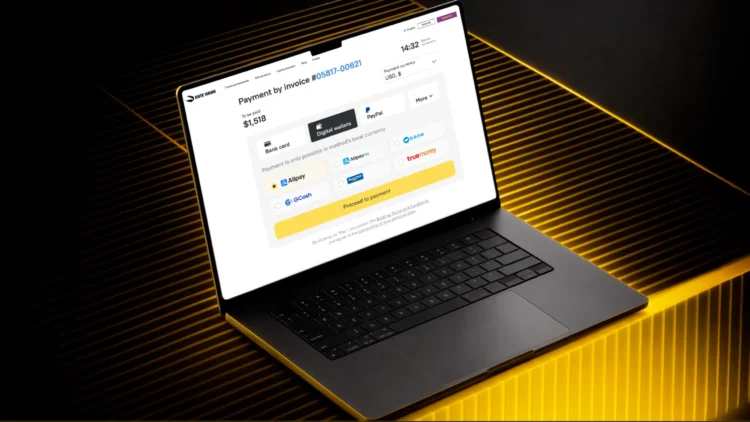

B2B go back and forth reserving machine RateHawk introduces a brand new virtual fee choice in Asia via integrations with a number of virtual wallets introduced all through the area.

The platform now accepts bills via GCash within the Philippines, TrueMoney in Thailand, TNG in Malaysia, Dana in Indonesia, and AlipayHK for patrons in China.

RateHawk selected the most well liked carrier for each and every nation, making sure immediate, safe, and handy transactions adapted to native personal tastes all through the area.

But even so virtual wallets, the platform provides a variety of fee choices starting from conventional bank cards, cord transfers, and money bills at check-in, to cutting edge answers corresponding to pay-by-link and PayPal.

In step with RateHawk’s regional director in APAC Erik Akhmetgaliev: “We’ve built-in virtual wallets in Asia because of their exceptional reputation amongst each companies and customers. This replace complements fee flexibility, which is very important for go back and forth execs navigating a fast-moving marketplace and more and more fragmented buyer personal tastes. At RateHawk, go back and forth brokers can simply select probably the most handy structure for themselves and their shoppers.”

Optimising use of Asia’s main fee means

Since 2020, virtual wallets have emerged because the main fee means in Asia, in particular inside the Asia Pacific (APAC) area.

According to contemporary analyses, virtual wallets account for just about 70 % of all transactions in APAC, highlighting their speedy adoption and dominance within the regional bills panorama.

Akhmetgaliev added: “The combination of virtual wallets is a part of our regional technique, concerned with creating native answers and supporting Asian go back and forth execs of their virtual transformation. As we proceed to enlarge our presence around the APAC area, we’re dedicated to handing over related answers adapted to our companions’ wishes.”