Startups and

innovation extra extensively are vital around the shuttle trade, spurring

developments that incessantly faucet into rising applied sciences to create higher

reviews for vacationers or to give a boost to potency and operations for providers

and stakeholders.

Each and every November

PhocusWire publishes its choice of the 25 shuttle startups poised to face

out within the coming 12 months. There were 150 firms identified during the

Scorching 25 courting again to November 2018 and jointly the ones startups have raised

just about $2.5 billion bucks.

Investment is however

one measure of the well being of the shuttle startup ecosystem and investor

self belief, however this can be a significant indicator.

PhocusWire’s sister logo, Phocuswright, tracks this

information in Phocuswright’s Commute Startups

Interactive Database, which contains greater than 4,600 firms

that experience generated greater than 8,500 investment rounds totaling over $200 billion

from virtually 8,400 buyers since 2005.

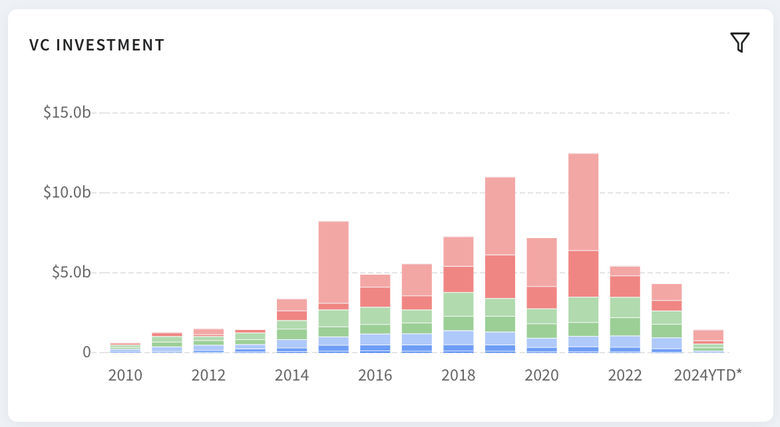

The information displays that shuttle investment totaled $5.3 billion in 2023, down considerably from $12 billion in 2022, and that 2024 is at about the similar tempo with $3.1 billion raised via overdue June.

The slowdown in

shuttle investment correlates with a broader slowdown within the task a raffle

capital companies. In keeping with a March 2024 Industry Insider article containing an

research of Pitchbook information, “The quantity

of energetic conventional VCs in project capital offers in the US peaked

at 18,504 in 2021. … That fell to fifteen,985 in 2022 and to 9,966 remaining 12 months.”

And but, whilst the present macroeconomic atmosphere is difficult, some shuttle startups have raised important rounds already this 12 months, particularly TravelPerk’s $104 million Sequence D-1 extension in January, Mews’ $110 Sequence D in March and Guesty’s $130 million Sequence F in April.

The listing

To deliver extra

transparency to shuttle buyers’ task and methods, PhocusWire remaining 12 months started

publishing a listing of the highest buyers in shuttle generation.

The listing is primarily based

on research via Phocuswright senior supervisor of analysis and innovation, Mike

Coletta.

Very similar to remaining

12 months, the research highlights the buyers which can be maximum energetic or are

contributing probably the most non-debt investment to the ecosystem. For the reason that explicit

quantities of contributions via every investor in every investment spherical is typically

now not publicly to be had, the research zeroed in on those that invested in at

least 3 shuttle firms between Might 2023 and Might 2024 and/or have a

explicit focal point on shuttle and mentioned plans to speculate extra.

According to the ones

standards, following is the listing of most sensible shuttle tech buyers and a pattern of

the firms they have got invested in throughout the required time frame, with

hyperlinks to our protection of the startups’ investment as appropriate.

“Making an allowance for

the hot drastic downturn in investment, or even with indicators of softening call for

at the horizon, it’s unbelievable to look buyers proceeding

to wager on shuttle, from stalwarts like Thayer, JetBlue Ventures and Plug and

Play to newbies like Antler and Gaingels,” Coletta stated.

- Thayer

Ventures/Derive Ventures – 13 investments together with Mews, Level.me, Canary,

Directo - Antler – 7

investments together with Airalo, Resolve and TravelTail - JetBlue

Ventures – 6 investments together with Avnos, NLX and The next day.io - Plug and Play

Tech Heart – 6 investments together with Neoke, Level.me and Sherpa - TechStars – 4 investments

together with NaviSavi, SquadTrip and TripSlip - Gaingels – 4 investments

together with Anywhere, Level.me and Summer season - FJ Labs – 3 investments:

Dharma, Fairlyne and FlyFlat - SpeedInvest – 3

investments: Fairlyne, Raus and Smiler

Honorable

mentions:

Investor

insights

We additionally reached

out to the firms in this listing to collect insights about their funding

methods, how they paintings with their portfolio firms, the place they see

alternatives for innovation and their take at the hype round synthetic

intelligence. Listed here are a few of the ones responses, in some circumstances edited for

brevity.

What are the

key standards you believe when comparing an funding alternative?

Kristi Choi, early

level investor at Plug and Play Tech Heart: Whilst more than a few elements pass into our

funding decision-making procedure, as early-stage buyers, robust conviction

within the founder(s) is key. Firms will undergo more than a few levels and,

in lots of circumstances, product iterations. In spite of everything, we’re taking a look

for founder(s) who’re targeted and decisive, have awesome execution talents and

know when to make the suitable turns on the proper time. We additionally ask ourselves if

that is the suitable individual to be fixing this precise drawback. The solutions to those

questions must be a very easy sure around the board.

Jeroen Arts,

spouse within the marketplaces and shopper funding workforce at SpeedInvest: We

pleasure ourselves with being the primary institutional backer in maximum of our

portfolio firms. If you end up making an investment at such an early level, probably the most

essential standards we spend money on are the people who find themselves development the product and

provider. Within the seed-phase of an organization, 99% of the adventure remains to be forward of

the corporate and, as such, we charge the workforce and their talent to execute because the

maximum essential.

Chris Hemmeter, managing

director at Thayer Ventures: We focal point on 5 issues in particular: marketplace

dynamics, unit economics, go-to-market engine, development and other people.

In particular, we’re on the lookout for huge addressable markets or smaller segments

which can be increasing rapid, robust unit economics that promise capital potency,

a repeatable go-to-market movement this is in line with the previous

traits and revenues normally above $2 million to $5 million. Other people, on the other hand,

is via a ways an important. We’re on the lookout for particular leaders who can

encourage.

Lorenzo Thione,

managing director of Gaingels: We take a look at the enterprise alternative to create a

huge sustainable corporate, in a big sufficient marketplace to pressure really extensive

returns. This additionally is dependent upon comparing the corporate’s aggressive benefits

both rooted in generation, product or workforce, and its unit economics. In spite of everything,

and one of the crucial essential component we believe is the founding workforce. Co-investors and valuation come into play too, however they’re much less central to our

funding selections.

In spite of everything, we’re on the lookout for founder(s) who’re targeted and decisive, have awesome execution talents and know when to make the suitable turns on the proper time.

Kristi Choi – Plug and Play

Jeff Weinstein,

spouse at FJ Labs: Our favourite startup to spend money on is one this is appearing

early semblances of product marketplace have compatibility, however isn’t but at scale. We adore our

capital for use for scaling companies briefly with operating unit economics.

How do you

love to paintings together with your portfolio firms?

Plug and Play/Choi: We

position a large number of believe at the founders that we wager on, and we attempt so as to add price

via leveraging our intensive world community to glue our portfolio firms

with possible shoppers, companions and trade professionals. Plug and Play works

intently with over 600 companies globally throughout 20+ industries, and we’re

repeatedly figuring out enterprise construction alternatives for our portfolio

with the objective of shortening gross sales cycles. Our task is to be grasp matchmakers.

For the sooner level firms, our type can considerably assist with

attaining and fine-tuning product marketplace have compatibility.

Gaingels/Thione:

We paintings similar to a conventional minority investor that does not take board

seats. As a result of now we have a big portfolio we have a tendency to be extra reactive relatively

than proactive, however we will step in to enhance our firms each time they want.

Our huge portfolio and community of making an investment contributors make Gaingels a

in particular treasured and supportive investor for corporations searching for

introductions to possible enterprise companions, shoppers and/or different buyers.

We additionally assist our portfolio firms via bringing various capital on their cap desk

and making room for underrepresented buyers, serving to them with creating

their forums of director and advisory, via sourcing and recommending applicants

from underrepresented backgrounds and supporting them of their recruiting

efforts via serving to them faucet into swimming pools of various ability they won’t have

get admission to to.

Thayer/Hemmeter:

We believe ourselves a strategic investor and prefer to mention that we paintings with

our firms between board conferences, now not simply at board conferences. We attempt to

function their enterprise construction, gross sales and technique spouse and concentrate on

opening doorways and riding motion. I for my part spent the majority of my occupation

development companies and take into account that serving to marketers connect to

possible shoppers is the main definition of “price

upload.”

The place do you

see the largest alternative for innovation nowadays in shuttle?

Plug and Play/Choi: We’re these days having many conversations

about convergence within the shuttle trade with more and more built-in vertical

device. There’s been heightened call for from shoppers

and brokers for a one-stop store, but the trade stays fragmented, inflicting

friction. We’ve been seeing extra of this convergence

going down in recent years, particularly at the company shuttle aspect, with important

task in fintech, expense control and shuttle reserving. We’re conserving a detailed eye on different

sub-sectors to spot an identical tendencies and patterns.

Thayer/Hemmeter:

The lodging tech stack, vertical device and services and products, actions and

reviews, similar bills answers, loyalty and shopper are one of the crucial

spaces the place we’re concentrating. We also are very curious about AI however most effective because it

relates to the appliance layer and the way it solves fascinating issues within the

shuttle house.

For plenty of AI startups, we fear that they’re working on an more and more accelerating treadmill, eating large quantities of capital simply to stick in position.

Jeff Weinstein – FJ Labs

SpeedInvest/Arts:

At the shopper aspect, we see a transparent shift towards a extremely personalised and

seamless shuttle reserving revel in. Slightly than offering shoppers with “knowledge,” we see platforms leveraging AI and information

to provide extremely adapted shuttle itineraries. Moreover, with the speedy buildup of infrastructure and functions of AI, there’s a transparent trail to

self reliant shuttle brokers that can ultimately maintain the tedious procedure

of reserving your go back and forth.

In a an identical

vein, but much less obtrusive, we see AI additionally being a large agent for exchange at the B2B

aspect. There are a large number of new applied sciences coming on-line that can let us

run leaner and smarter shuttle operations. Whether or not it’s at

airports, in lodges or someplace alongside the way in which of your adventure, we consider

there will probably be a brand new set of shuttle startups to begin to unravel one of the crucial

present inefficiencies.

How are you

seeing the hype round AI have an effect on the shuttle startup panorama?

Plug and Play/Choi: There

was once a large number of noise to sift via within the previous months. I feel a few of that

noise has died down, and we’re now beginning to see impactful

programs increase which can be hyper-focused on lowering prices and making improvements to

provider high quality in shuttle. There’s a ton of possible, and the shuttle startup

panorama will mirror that. On the other hand, like in lots of different industries, there may be

these days an important hole in company adoption of generative AI programs, so it’ll take a while.

FJ Labs/Weinstein:

AI is seismically moving the taking part in box for startups, so we predict so much

about defensibility (see the superb technique e book 7 Powers via Hamilton Helmer for a framework

that we take into accounts sustainable price introduction). For plenty of AI startups, we

fear that they’re working on an more and more accelerating treadmill,

eating large quantities of capital simply to stick in position. So we choose

to concentrate on slim programs of AI inside present workflows or device

gear that get pleasure from AI, relatively than AI itself.

Thayer/Hemmeter:

AI for shuttle startups is a device, now not an answer in and of itself. What’s maximum fascinating is the enterprise

drawback being solved — in different phrases, how the software is being leveraged within the

utility. It’s crucial and thrilling new toolbox, to make certain, and plenty of startups are understanding easy methods to resolve issues in new

techniques. That stated, integrating AI into a nasty thought doesn’t get very

a ways. It’s additionally essential to notice that not like

previous inventions that stuck incumbent avid gamers flat-footed, AI has been a

central a part of their paintings for a few years, and they have got the facility to care for

management. It’s not likely that any startup will “out-AI” the massive guys, whilst that wasn’t true for cell, for instance.

Gaingels/Thione:

Whilst there are a subset of businesses that draw in headlines, buyers and

consideration and subsequently are ready to boost at inflated valuation, the real

financial have an effect on of AI in the longer term is not likely to be hyped. There may be an

monumental quantity of VC spending this is forward of the price liberate chain as a result of

it is investment compute deployment, and a few of that capital is also liable to

being devalued via long run enhancements at the {hardware} aspect, however the real liberate

of price from a productiveness and staffing perspective for the small and

medium endeavor, particularly in conventional/uninteresting industries is but to be

noticed.

What’s your

outlook for startup investment typically around the shuttle trade for the following

few years?

SpeedInvest/Arts: Whilst shuttle has picked up significantly because the finish of the pandemic, as individuals are satisfied to be again exploring the arena, VC funding within the shuttle trade has – moderately counterintuitively – traveled the other way (see chart underneath from Dealroom). We see much less shuttle startups being funded (throughout all levels), and the decrease quantity of general invested capital in shuttle startups is getting extra concentrated in a smaller team of “winners.” I do consider that this robust bifurcation available in the market will ease somewhat within the coming 12-24 months; on the other hand, fundraising for startups on the whole, and shuttle startups in particular, has modified 180 levels vs. its top 12 months of 2021.

Plug and Play/Choi: We’re

positive. There’s nonetheless a large number of paintings to be performed and

a number of alternatives to construct significant generation around the shuttle

trade.

Thayer/Hemmeter:

I’m bullish, however now not from a “selection of

offers” and “general

bucks deployed” standpoint. I’m bullish in regards to the high quality of startups in

shuttle and the dislocation and disruption going down around the $10 trillion

price chain. For my part, taking a look at general selection of offers and absolute bucks

deployed says extra about project capital than startups. Too many

shoot-for-the-moon concepts were given funded when money was once unfastened, and VCs had been desperate to

deploy. On the identical time, spherical sized grew too huge as VCs regarded to completely make investments

with the intention to get again to their LPs with the following Roman numeral fund. The outcome

was once quite a lot of noise available in the market that, paradoxically, generated headwinds for

the most productive firms and an excessive amount of money that harmed the groups that took it on. We

are, fortunately, residing in numerous instances and are again to high quality, potency

and grit. That this is occurring towards a dynamic world trade like shuttle

may be very thrilling. I feel we will be able to proceed to look nice firms born throughout

this era, and disciplined investment will indisputably be there to enhance them.

Gaingels/Thione:

Persons are again to touring to equivalent or upper than pre-pandemic ranges. They

also are discovering techniques to do extra with much less as a result of emerging inflation, so

anyplace generation can assist with figuring out shuttle alternatives whilst

lowering value, maximizing usage and stock control, eliminating

middleman inefficiencies that building up prices and renewing a focal point on

experiential relatively than luxurious shuttle, will probably be an area ripe for funding and

price introduction around the shuttle price chain.

FJ Labs/Weinstein:

Certainly one of my favourite tendencies at this time is making an investment in startups that dramatically

beef up productiveness inside present communique workflows. Which means that

other people can grow to be shoppers with out requiring large habits adjustments.

For instance, we invested in FlyFlat, which is a business-class flight reserving

provider the place all of the UI/UX lives inside Whatsapp/SMS/your messenger of

selection.

Phocuswright’s Commute Startups Interactive Database

You not want an Open Get right of entry to

subscription to engage with information on hundreds of shuttle startups based

since 2005. This dynamic database of shuttle firms features a wealth of information

on startups, being able to clear out, type and drill down at the knowledge

this is maximum related to your enterprise.