Japan’s financial system is sending blended indicators. Its commute marketplace isn’t.

After years of deflationary drag, Japan entered a brand new bankruptcy in 2024. Financial enlargement used to be modest, however the indicators had been unmistakable: the primary interest-rate hike in 17 years, report fairness markets and the most powerful salary enlargement in additional than 3 many years. A susceptible yen amplified the have an effect on, supercharging inbound commute and handing over actual positive factors to regional economies at the same time as family call for remained wary into 2025.

For commute, this marked a blank pivot from restoration to revival.

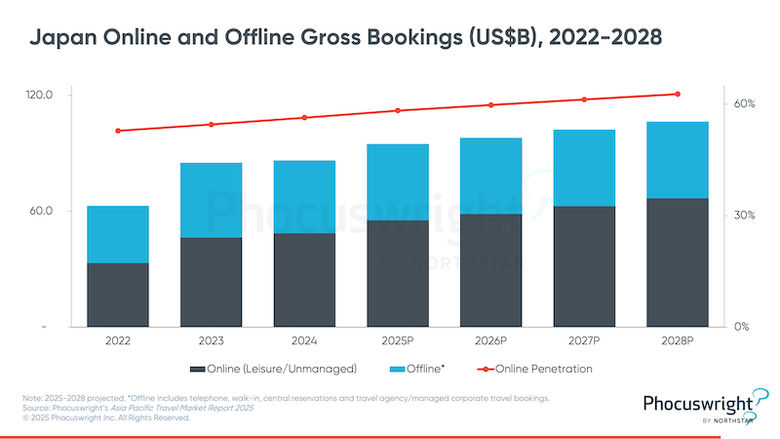

In keeping with Phocuswright’s Japan Commute Marketplace Necessities 2025 document, gross bookings moved previous 2019 ranges in 2023 and speeded up once more in 2024, emerging 9% to ¥13.1 trillion. In native forex phrases, momentum is powerful. In U.S. bucks, it’s a unique tale—enlargement stays muted, and the marketplace is not going to reclaim its 2019 USD measurement even via 2028. The takeaway is obvious: Inbound call for is booming, however the economics of the marketplace are converting.

Towards that backdrop, Japan is now targeted much less on whether or not tourism grows—and extra on how.

From enlargement to guardrails

Japan is not simply attracting guests. It’s managing them.

Crowding in cultural districts, power on herbal websites and pressure on delivery techniques have driven sustainability from idea to coverage. Nationwide tourism plans now position dispersal and customer revel in along headline enlargement goals—with transparent metrics to again them up.

What used to be as soon as encouragement is changing into execution.

Coverage with penalties

A few of Japan’s maximum iconic locations are surroundings the tone.

New get entry to laws, customer caps, charges and taxes are getting used to offer protection to citizens, maintain heritage and affect traveler habits. Upcoming adjustments to visas, departure taxes, tax-free buying groceries and virtual commute authorization sign a extra structured, data-led way to tourism control—one designed to maintain enlargement with out eroding high quality.

Those measures received’t sluggish call for. They are going to reshape it.

The areas step into the highlight

Relieving power on main towns manner redirecting call for—and funding.

Rail extensions, airline incentives and coordinated regional promotion are quietly increasing what “Japan commute” looks as if past the Golden Course. The purpose is to flatten peaks, unfold financial advantages and produce secondary locations into the mainstream with out sacrificing revel in.

Japan as a world aviation connector

Inbound enlargement is reinforcing one thing larger: Japan’s function as a world hub.

Emerging customer volumes are supporting upper frequencies and broader long-haul achieve, strengthening Tokyo’s place as a switch level between Asia, North The us and past. Community carriers and challengers alike are increasing, including density that advantages each inbound tourism and international connectivity.

Why this issues

Japan’s commute marketplace isn’t simply greater. It’s extra advanced.

Foreign money dynamics, coverage shifts, sustainability pressures and aviation technique are converging without delay.

Phocuswright’s Japan Commute Marketplace Necessities 2025

This document explains how those forces attach—and what they imply for firms making choices in, or about, Japan.

Japan’s financial system is sending blended indicators. Its commute marketplace isn’t.

After years of deflationary drag, Japan entered a brand new bankruptcy in 2024. Financial enlargement used to be modest, however the indicators had been unmistakable: the primary interest-rate hike in 17 years, report fairness markets and the most powerful salary enlargement in additional than 3 many years. A susceptible yen amplified the have an effect on, supercharging inbound commute and handing over actual positive factors to regional economies at the same time as family call for remained wary into 2025.

For commute, this marked a blank pivot from restoration to revival.

In keeping with Phocuswright’s Japan Commute Marketplace Necessities 2025 document, gross bookings moved previous 2019 ranges in 2023 and speeded up once more in 2024, emerging 9% to ¥13.1 trillion. In native forex phrases, momentum is powerful. In U.S. bucks, it’s a unique tale—enlargement stays muted, and the marketplace is not going to reclaim its 2019 USD measurement even via 2028. The takeaway is obvious: Inbound call for is booming, however the economics of the marketplace are converting.

Towards that backdrop, Japan is now targeted much less on whether or not tourism grows—and extra on how.

From enlargement to guardrails

Japan is not simply attracting guests. It’s managing them.

Crowding in cultural districts, power on herbal websites and pressure on delivery techniques have driven sustainability from idea to coverage. Nationwide tourism plans now position dispersal and customer revel in along headline enlargement goals—with transparent metrics to again them up.

What used to be as soon as encouragement is changing into execution.

Coverage with penalties

A few of Japan’s maximum iconic locations are surroundings the tone.

New get entry to laws, customer caps, charges and taxes are getting used to offer protection to citizens, maintain heritage and affect traveler habits. Upcoming adjustments to visas, departure taxes, tax-free buying groceries and virtual commute authorization sign a extra structured, data-led way to tourism control—one designed to maintain enlargement with out eroding high quality.

Those measures received’t sluggish call for. They are going to reshape it.

The areas step into the highlight

Relieving power on main towns manner redirecting call for—and funding.

Rail extensions, airline incentives and coordinated regional promotion are quietly increasing what “Japan commute” looks as if past the Golden Course. The purpose is to flatten peaks, unfold financial advantages and produce secondary locations into the mainstream with out sacrificing revel in.

Japan as a world aviation connector

Inbound enlargement is reinforcing one thing larger: Japan’s function as a world hub.

Emerging customer volumes are supporting upper frequencies and broader long-haul achieve, strengthening Tokyo’s place as a switch level between Asia, North The us and past. Community carriers and challengers alike are increasing, including density that advantages each inbound tourism and international connectivity.

Why this issues

Japan’s commute marketplace isn’t simply greater. It’s extra advanced.

Foreign money dynamics, coverage shifts, sustainability pressures and aviation technique are converging without delay.

Phocuswright’s Japan Commute Marketplace Necessities 2025

This document explains how those forces attach—and what they imply for firms making choices in, or about, Japan.