In 2021, the cryptocurrency marketplace regained the general public’s consideration

as the price of 1 Bitcoin broke via its earlier all-time excessive of just about

$20,000 to succeed in a value of just about $70,000.

Then again, in 2022, the marketplace suffered a large number of high-profile

screw ups, together with the crash in price of stablecoin supplier Terra’s UST and the cave in of crypto change FTX. By way of

2024, the fallout from the ones occasions and others, and next endure marketplace (in

which many cryptocurrencies fell 90% from their heights), intended that crypto had

as soon as once more pale from the common particular person’s awareness.

Despite the fact that sentiment became certain as Bitcoin rallied and once more

crossed $70,000 in March 2024, pushed by way of the approval of Bitcoin ETFs (which permit funding in futures contracts reasonably than

cryptocurrency itself), fear in regards to the marketplace nonetheless lingers for plenty of.

This fear has been heightened by way of pending governmental rules designed

to restrict cryptocurrency enlargement, such because the Safety and Trade Fee’s

litigation efforts classifying many cryptocurrencies as securities.

The regulator has filed court cases towards 31 crypto corporations it accused of violating U.S. securities

legislation. Despite the fact that the SEC ended one of its investigations in June, given the crypto sector’s

tumultuous historical past it’s unsurprising that many within the commute business have

pushed aside cryptocurrency as a passing fad, as they did after the similar

2017 crypto and blockchain hype bubble popped.

Subscribe to our e-newsletter beneath

Then again, flying underneath the everyday commute business radar is the truth

that the central banks of many countries have begun issuing virtual currencies of

their very own. Those central financial institution virtual currencies (CBDCs) have traits

very similar to cryptocurrencies, however with one crucial distinction: Versus

the decentralized nature of many cryptocurrencies, with Bitcoin being the high

instance, CBDCs are absolutely centralized and feature been created, promoted and

managed by way of present central banks. For extra on centralization as opposed to

decentralization, see The Decentralized Computing

Long term (2021).

The aim of a CBDC is to behave as a virtual model of a rustic’s

forex. As few commute providers and shops recently settle for virtual

forex nowadays, the creation of state-sponsored virtual forex provides a brand new

wrinkle to the kinds of bills that might wish to be authorised.

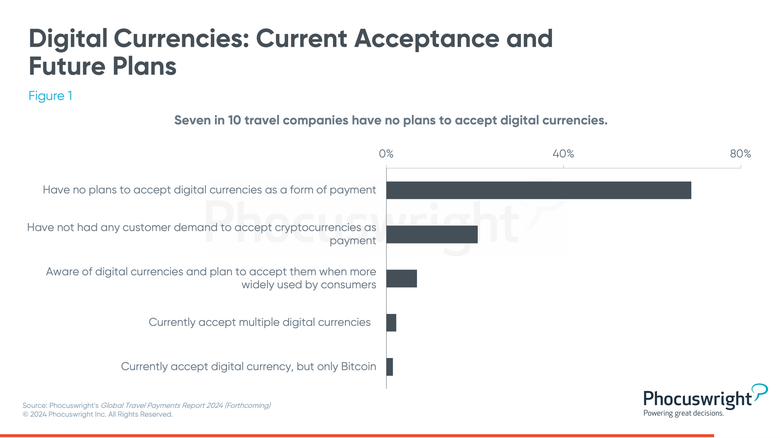

Phocuswright’s

coming near near World Go back and forth Bills Record 2024 illustrates the lag in

acceptance of virtual currencies, with seven in 10 commute corporations having no

plans to just accept them.

CBDC’s have an effect on at the commute business

To prevail, CBDCs wish to are compatible throughout the present fee

infrastructure. A central financial institution might factor this virtual cash to monetary

establishments for distribution, and even immediately to a client’s virtual pockets.

The patron would pay at checkout a lot the similar manner they do nowadays

with a telephone. The one caveat is that the pockets wanted for this transaction

will have to be a tool pockets that retail outlets price.

For an outline of pockets varieties, see Who Owns the Buyer? How About

the Consumers Themselves! The

article additionally addresses the will for tool wallets to carry self-sovereign

id (SSI) profiles. If CBDCs proliferate, those might act as a method for

better distribution of tool wallets as neatly.

To arrange for the emergence of CBDCs, commute corporations

will have to:

- Overview international markets, acknowledge the ones which are advancing their

CBDC timetable and analyze its have an effect on on commute fee methods. - Sign up for running teams such because the Ecu Central Financial institution’s “Name for applicants to

take part within the virtual euro scheme infrastructure-related necessities

workstream.” - Assign a crew or person to turn out to be trained on CBDCs, observe

their growth and give a contribution to a technique for CBDC acceptance in accordance with

general marketplace acceptance.

Whilst shopper adoption of virtual currencies up to now has been

gradual, complete rollouts of CBDCs within the coming years manner maximum customers can have

get right of entry to to virtual forex as a type of fee.

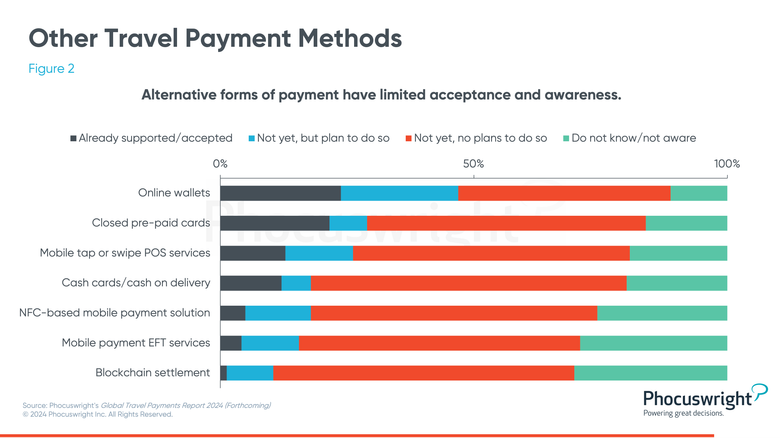

The commute business recently struggles with selection kinds of

fee, and subsequently the shift to complete virtual currencies, even the ones

supplied by way of the federal government, would require extensive business collaboration. In

Phocuswright’s coming near near World Go back and forth Bills Record 2024, commute corporations

of all sizes and in more than a few geographies showcase a resistance to the adoption selection

kinds of fee (AFPs), although international acceptance is rising in different

industries.

The mud has no longer settled at the CBDC factor, however obviously a couple of

governments are pushing forward with their CBDC efforts and arrangements wish to

be made.

In 2021, the cryptocurrency marketplace regained the general public’s consideration

as the price of 1 Bitcoin broke via its earlier all-time excessive of just about

$20,000 to succeed in a value of just about $70,000.

Then again, in 2022, the marketplace suffered a large number of high-profile

screw ups, together with the crash in price of stablecoin supplier Terra’s UST and the cave in of crypto change FTX. By way of

2024, the fallout from the ones occasions and others, and next endure marketplace (in

which many cryptocurrencies fell 90% from their heights), intended that crypto had

as soon as once more pale from the common particular person’s awareness.

Despite the fact that sentiment became certain as Bitcoin rallied and once more

crossed $70,000 in March 2024, pushed by way of the approval of Bitcoin ETFs (which permit funding in futures contracts reasonably than

cryptocurrency itself), fear in regards to the marketplace nonetheless lingers for plenty of.

This fear has been heightened by way of pending governmental rules designed

to restrict cryptocurrency enlargement, such because the Safety and Trade Fee’s

litigation efforts classifying many cryptocurrencies as securities.

The regulator has filed court cases towards 31 crypto corporations it accused of violating U.S. securities

legislation. Despite the fact that the SEC ended one of its investigations in June, given the crypto sector’s

tumultuous historical past it’s unsurprising that many within the commute business have

pushed aside cryptocurrency as a passing fad, as they did after the similar

2017 crypto and blockchain hype bubble popped.

Subscribe to our e-newsletter beneath

Then again, flying underneath the everyday commute business radar is the truth

that the central banks of many countries have begun issuing virtual currencies of

their very own. Those central financial institution virtual currencies (CBDCs) have traits

very similar to cryptocurrencies, however with one crucial distinction: Versus

the decentralized nature of many cryptocurrencies, with Bitcoin being the high

instance, CBDCs are absolutely centralized and feature been created, promoted and

managed by way of present central banks. For extra on centralization as opposed to

decentralization, see The Decentralized Computing

Long term (2021).

The aim of a CBDC is to behave as a virtual model of a rustic’s

forex. As few commute providers and shops recently settle for virtual

forex nowadays, the creation of state-sponsored virtual forex provides a brand new

wrinkle to the kinds of bills that might wish to be authorised.

Phocuswright’s

coming near near World Go back and forth Bills Record 2024 illustrates the lag in

acceptance of virtual currencies, with seven in 10 commute corporations having no

plans to just accept them.

CBDC’s have an effect on at the commute business

To prevail, CBDCs wish to are compatible throughout the present fee

infrastructure. A central financial institution might factor this virtual cash to monetary

establishments for distribution, and even immediately to a client’s virtual pockets.

The patron would pay at checkout a lot the similar manner they do nowadays

with a telephone. The one caveat is that the pockets wanted for this transaction

will have to be a tool pockets that retail outlets price.

For an outline of pockets varieties, see Who Owns the Buyer? How About

the Consumers Themselves! The

article additionally addresses the will for tool wallets to carry self-sovereign

id (SSI) profiles. If CBDCs proliferate, those might act as a method for

better distribution of tool wallets as neatly.

To arrange for the emergence of CBDCs, commute corporations

will have to:

- Overview international markets, acknowledge the ones which are advancing their

CBDC timetable and analyze its have an effect on on commute fee methods. - Sign up for running teams such because the Ecu Central Financial institution’s “Name for applicants to

take part within the virtual euro scheme infrastructure-related necessities

workstream.” - Assign a crew or person to turn out to be trained on CBDCs, observe

their growth and give a contribution to a technique for CBDC acceptance in accordance with

general marketplace acceptance.

Whilst shopper adoption of virtual currencies up to now has been

gradual, complete rollouts of CBDCs within the coming years manner maximum customers can have

get right of entry to to virtual forex as a type of fee.

The commute business recently struggles with selection kinds of

fee, and subsequently the shift to complete virtual currencies, even the ones

supplied by way of the federal government, would require extensive business collaboration. In

Phocuswright’s coming near near World Go back and forth Bills Record 2024, commute corporations

of all sizes and in more than a few geographies showcase a resistance to the adoption selection

kinds of fee (AFPs), although international acceptance is rising in different

industries.

The mud has no longer settled at the CBDC factor, however obviously a couple of

governments are pushing forward with their CBDC efforts and arrangements wish to

be made.