The go back and forth marketplace in america endured its stellar restoration in 2022, with a complete gross bookings build up of 51% over the prior 12 months. On-line go back and forth companies comprised simply over one-fifth of the overall U.S. marketplace all the way through this era, in keeping with new Phocuswright analysis incorporated in its U.S. On-line Commute Company Marketplace File 2022-2026.

Whilst OTAs like Hopper and HotelTonight have at all times been app-first or app-only, cell was once only one a part of the puzzle for the bigger OTAs. However a number of components, amongst them decreasing their advertising spend and their reliance on Google, at the side of their wish to gain first-party information, have made direct buyer interplay by way of their very own websites and apps increasingly more necessary.

The bigger OTAs like Expedia and Reserving have additionally emphasised the significance in their apps as a channel to win and retain shoppers for the longer term. Additional underlining the significance of apps, in keeping with Expedia its app customers pressure 2.5 instances the gross benefit and repeat trade over an 18-month length in comparison with a non-app consumer. On the finish of 2022, Expedia had 60% extra energetic app customers than any prior 12 months. Reserving noticed about 45% of its room nights booked via its app in 2022, a 13 share level build up over 2019.

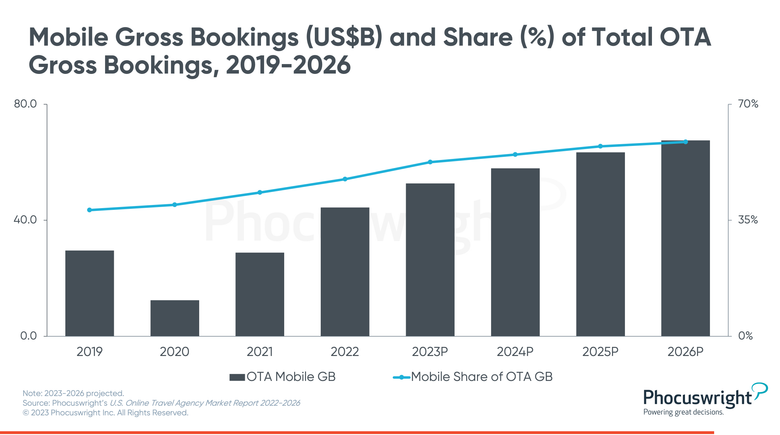

40-seven % of OTA gross bookings have been booked by way of cell in 2022, just about 10 issues upper than in 2019 (see determine underneath).

Cell proportion will keep growing as the huge OTAs proceed their push to get shoppers to transact on their apps. In 2023, greater than part of OTA gross bookings are projected to come back from cell.

Be told extra!

The go back and forth marketplace in america endured its stellar restoration in 2022, with a complete gross bookings build up of 51% over the prior 12 months. On-line go back and forth companies comprised simply over one-fifth of the overall U.S. marketplace all the way through this era, in keeping with new Phocuswright analysis incorporated in its U.S. On-line Commute Company Marketplace File 2022-2026.

Whilst OTAs like Hopper and HotelTonight have at all times been app-first or app-only, cell was once only one a part of the puzzle for the bigger OTAs. However a number of components, amongst them decreasing their advertising spend and their reliance on Google, at the side of their wish to gain first-party information, have made direct buyer interplay by way of their very own websites and apps increasingly more necessary.

The bigger OTAs like Expedia and Reserving have additionally emphasised the significance in their apps as a channel to win and retain shoppers for the longer term. Additional underlining the significance of apps, in keeping with Expedia its app customers pressure 2.5 instances the gross benefit and repeat trade over an 18-month length in comparison with a non-app consumer. On the finish of 2022, Expedia had 60% extra energetic app customers than any prior 12 months. Reserving noticed about 45% of its room nights booked via its app in 2022, a 13 share level build up over 2019.

40-seven % of OTA gross bookings have been booked by way of cell in 2022, just about 10 issues upper than in 2019 (see determine underneath).

Cell proportion will keep growing as the huge OTAs proceed their push to get shoppers to transact on their apps. In 2023, greater than part of OTA gross bookings are projected to come back from cell.

Be told extra!