Contemporary bulletins from Reserving.com, which introduced its Genius Rewards Visa Signature Credit score Card within the U.S., and Alaska Airways, which debuted its top rate Atmos Rewards Summit Visa Countless Card, constitute greater than new plastic in your pockets. They sign the acceleration of the “monetary go back and forth ecosystem,” the place the limits between banking, loyalty techniques and go back and forth services and products are steadily converging.

Shuttle firms are reworking into monetary services and products platforms, banks are morphing into go back and forth companies and loyalty techniques are changing into refined funding cars. It is like staring at 3 separate chess video games merging into one impossibly advanced board.

The U.S. marketplace’s distinctive merit on this house stems from the interchange arbitrage alternative as opposed to the EU’s 0.3% interchange charge caps. U.S. airways can seize 1%-3% consistent with transaction, investment the ones horny mileage advantages that Eu carriers can handiest dream about.

From loyalty to way of life integration

Essentially the most vital shift comes to increasing past transactional relationships towards way of life integration. Trendy go back and forth finance merchandise purpose to seize spending throughout classes that correlate with go back and forth habits: eating, leisure, fuel stations and groceries. This represents a basic shift in figuring out of person psychology—the popularity that go back and forth affinity extends a ways past the moments when you are in fact reserving flights.

Subscribe to our publication under

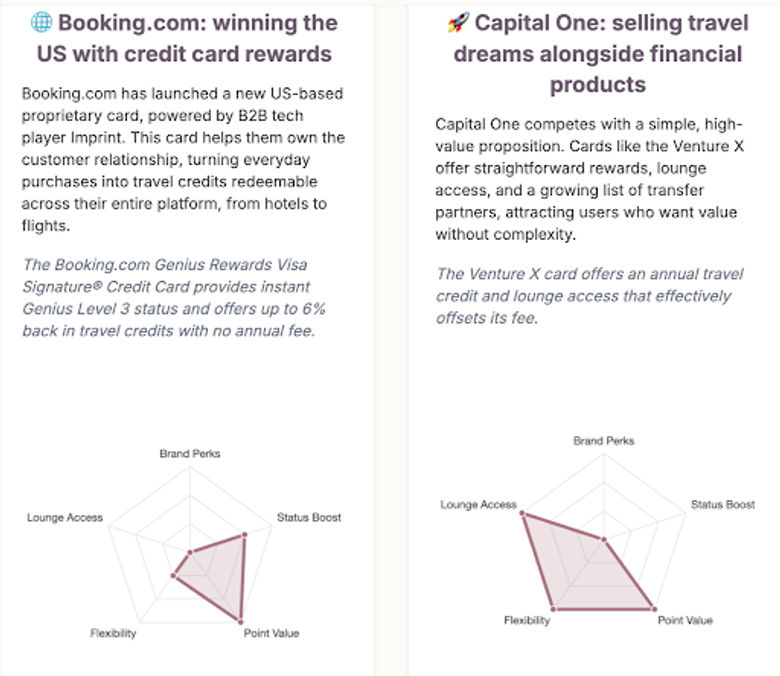

Reserving.com’s bank card technique exemplifies this method. Slightly than restricting rewards to lodge bookings, they are developing touchpoints right through the buyer’s day-to-day monetary lifestyles. Each and every espresso acquire turns into a micro-investment in long run go back and forth, each and every grocery run contributes to holiday fund accumulation. It is behavioral psychology meets monetary engineering, wrapped in a loyalty program.

For monetary establishments, the strategic common sense to amplify into go back and forth is compelling: Shuttle rewards are “sticky” in ways in which conventional banking merchandise are not. When consumers spend time amassing go back and forth features, switching prices between monetary establishments building up exponentially.

The strategic divide: Co-branded playing cards achieve vs. proprietary playing cards intensity

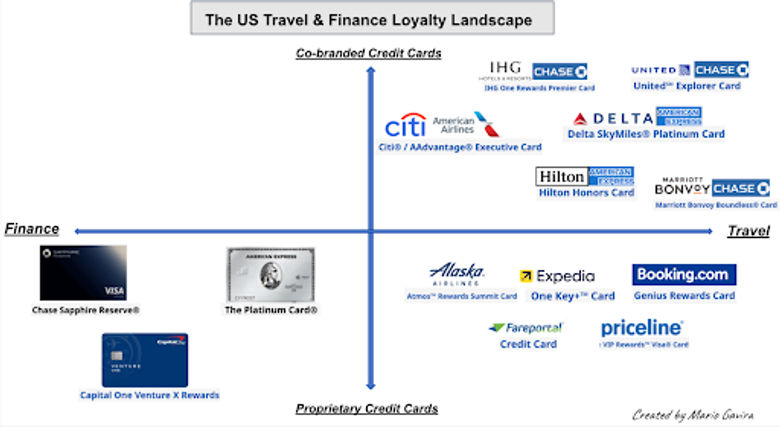

The go back and forth rewards panorama is essentially formed through two distinct, but interconnected, monetary product fashions: co-branded bank cards and basic go back and forth playing cards with transferable features.

The primary is a proprietary trail, the place manufacturers construct their very own direct-to-consumer monetary merchandise powered through B2B enablers. For monetary establishments like Capital One, this implies partnering with an organization like Hopper’s B2B department (HTS) whilst Reserving.com leveraged fintech startup Imprint to factor their very own branded bank card. It is a closed-loop machine that is helping those manufacturers to procure and retain consumers inside their very own ecosystem.

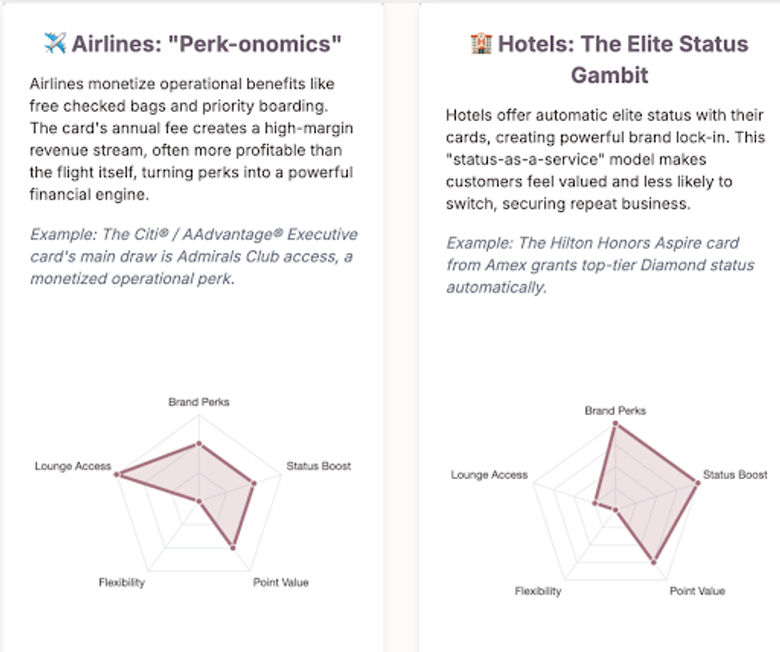

The second one, extra conventional strategic selection is the co-branded type, which leverages the complementary buyer segments of each a monetary establishment and a go back and forth supplier. On this type, the financial institution advantages from a brand new distribution channel and get right of entry to to a go back and forth logo’s unswerving buyer base whilst the go back and forth corporate positive aspects a high-margin earnings circulate and a strong device for buyer retention. It’s a win-win symbiotic dating.

In spite of everything, the large monetary gamers like Chase and Amex do not simply select one trail.They play all sides, providing a mixture of their very own playing cards and a complete portfolio of co-branded choices to enchantment to other traveler segments.

Strategic implications: The long run battlefield

The aggressive dynamics are reshaping alongside more than one dimensions concurrently. Airways now compete on monetary merchandise along routes and repair high quality. Inns compete with banks for buyer monetary relationships. Banks compete with go back and forth companies for reserving earnings.

For go back and forth manufacturers, the strategic choices have crystallized into a number of distinct paths:

- Area of interest top rate positioning: Center of attention on specialised traveler segments with curated, experiential rewards slightly than broad-market appeals. Marriott Bonvoy’s Bellagio fountain programming and Hilton’s non-public artist showcases exemplify this method.

- Strategic integration partnerships: Increase co-branding relationships with shared targets slightly than natural white-label preparations that erase logo identification

- Versatile forex techniques: Put in force cut up delicate functions (cash-plus-points) and extra obtainable, common rewards to counter elite standing oversaturation

For fintech platforms, the chance lies in changing into the invisible infrastructure layer—creating modular Instrument-as-a-Carrier answers for dynamic pricing, personalised provides and synthetic intelligence-driven loyalty optimization.

The knowledge merit: Predicting intent ahead of consciousness

Without equal prize on this convergence is not interchange charges or pastime source of revenue—it is predictive buyer intelligence. When a go back and forth corporate has visibility into entire spending patterns, they may be able to expect go back and forth habits with extraordinary accuracy. They know you are prone to ebook a travel ahead of you will have consciously made up our minds to go back and forth.

This transforms advertising from reactive call for seize to proactive intent nurturing. As a substitute of competing for consideration when consumers get started buying groceries, those platforms can determine and domesticate go back and forth wants ahead of they absolutely shape.

The brand new regulations of engagement

The go back and forth business’s include of embedded finance represents a basic reimagining of purchaser relationships. Conventional barriers between airways, resorts, banks and era platforms have blurred past reputation. Without equal imaginative and prescient comes to go back and forth firms serve as as complete way of life platforms, with monetary services and products because the connective tissue between quite a lot of person touchpoints.

The brand new go back and forth cash sport has begun, and the principles are nonetheless being written. The winners shall be those that be successful within the seamless integration of go back and forth experience with monetary services and products functions, developing reports and rewards that really feel distinctive in your logo.

The one simple task? Your pockets is set to get much more fascinating.

In regards to the writer…

The Phocuswright Convention 2025

Sign up for us in San Diego November 18-20 to listen to executives from Chase Shuttle and Hopper talk about how the go back and forth ecosystem is increasing to incorporate banks, club organizations, fintechs and different new platforms.

Contemporary bulletins from Reserving.com, which introduced its Genius Rewards Visa Signature Credit score Card within the U.S., and Alaska Airways, which debuted its top rate Atmos Rewards Summit Visa Countless Card, constitute greater than new plastic in your pockets. They sign the acceleration of the “monetary go back and forth ecosystem,” the place the limits between banking, loyalty techniques and go back and forth services and products are steadily converging.

Shuttle firms are reworking into monetary services and products platforms, banks are morphing into go back and forth companies and loyalty techniques are changing into refined funding cars. It is like staring at 3 separate chess video games merging into one impossibly advanced board.

The U.S. marketplace’s distinctive merit on this house stems from the interchange arbitrage alternative as opposed to the EU’s 0.3% interchange charge caps. U.S. airways can seize 1%-3% consistent with transaction, investment the ones horny mileage advantages that Eu carriers can handiest dream about.

From loyalty to way of life integration

Essentially the most vital shift comes to increasing past transactional relationships towards way of life integration. Trendy go back and forth finance merchandise purpose to seize spending throughout classes that correlate with go back and forth habits: eating, leisure, fuel stations and groceries. This represents a basic shift in figuring out of person psychology—the popularity that go back and forth affinity extends a ways past the moments when you are in fact reserving flights.

Subscribe to our publication under

Reserving.com’s bank card technique exemplifies this method. Slightly than restricting rewards to lodge bookings, they are developing touchpoints right through the buyer’s day-to-day monetary lifestyles. Each and every espresso acquire turns into a micro-investment in long run go back and forth, each and every grocery run contributes to holiday fund accumulation. It is behavioral psychology meets monetary engineering, wrapped in a loyalty program.

For monetary establishments, the strategic common sense to amplify into go back and forth is compelling: Shuttle rewards are “sticky” in ways in which conventional banking merchandise are not. When consumers spend time amassing go back and forth features, switching prices between monetary establishments building up exponentially.

The strategic divide: Co-branded playing cards achieve vs. proprietary playing cards intensity

The go back and forth rewards panorama is essentially formed through two distinct, but interconnected, monetary product fashions: co-branded bank cards and basic go back and forth playing cards with transferable features.

The primary is a proprietary trail, the place manufacturers construct their very own direct-to-consumer monetary merchandise powered through B2B enablers. For monetary establishments like Capital One, this implies partnering with an organization like Hopper’s B2B department (HTS) whilst Reserving.com leveraged fintech startup Imprint to factor their very own branded bank card. It is a closed-loop machine that is helping those manufacturers to procure and retain consumers inside their very own ecosystem.

The second one, extra conventional strategic selection is the co-branded type, which leverages the complementary buyer segments of each a monetary establishment and a go back and forth supplier. On this type, the financial institution advantages from a brand new distribution channel and get right of entry to to a go back and forth logo’s unswerving buyer base whilst the go back and forth corporate positive aspects a high-margin earnings circulate and a strong device for buyer retention. It’s a win-win symbiotic dating.

In spite of everything, the large monetary gamers like Chase and Amex do not simply select one trail.They play all sides, providing a mixture of their very own playing cards and a complete portfolio of co-branded choices to enchantment to other traveler segments.

Strategic implications: The long run battlefield

The aggressive dynamics are reshaping alongside more than one dimensions concurrently. Airways now compete on monetary merchandise along routes and repair high quality. Inns compete with banks for buyer monetary relationships. Banks compete with go back and forth companies for reserving earnings.

For go back and forth manufacturers, the strategic choices have crystallized into a number of distinct paths:

- Area of interest top rate positioning: Center of attention on specialised traveler segments with curated, experiential rewards slightly than broad-market appeals. Marriott Bonvoy’s Bellagio fountain programming and Hilton’s non-public artist showcases exemplify this method.

- Strategic integration partnerships: Increase co-branding relationships with shared targets slightly than natural white-label preparations that erase logo identification

- Versatile forex techniques: Put in force cut up delicate functions (cash-plus-points) and extra obtainable, common rewards to counter elite standing oversaturation

For fintech platforms, the chance lies in changing into the invisible infrastructure layer—creating modular Instrument-as-a-Carrier answers for dynamic pricing, personalised provides and synthetic intelligence-driven loyalty optimization.

The knowledge merit: Predicting intent ahead of consciousness

Without equal prize on this convergence is not interchange charges or pastime source of revenue—it is predictive buyer intelligence. When a go back and forth corporate has visibility into entire spending patterns, they may be able to expect go back and forth habits with extraordinary accuracy. They know you are prone to ebook a travel ahead of you will have consciously made up our minds to go back and forth.

This transforms advertising from reactive call for seize to proactive intent nurturing. As a substitute of competing for consideration when consumers get started buying groceries, those platforms can determine and domesticate go back and forth wants ahead of they absolutely shape.

The brand new regulations of engagement

The go back and forth business’s include of embedded finance represents a basic reimagining of purchaser relationships. Conventional barriers between airways, resorts, banks and era platforms have blurred past reputation. Without equal imaginative and prescient comes to go back and forth firms serve as as complete way of life platforms, with monetary services and products because the connective tissue between quite a lot of person touchpoints.

The brand new go back and forth cash sport has begun, and the principles are nonetheless being written. The winners shall be those that be successful within the seamless integration of go back and forth experience with monetary services and products functions, developing reports and rewards that really feel distinctive in your logo.

The one simple task? Your pockets is set to get much more fascinating.

In regards to the writer…

The Phocuswright Convention 2025

Sign up for us in San Diego November 18-20 to listen to executives from Chase Shuttle and Hopper talk about how the go back and forth ecosystem is increasing to incorporate banks, club organizations, fintechs and different new platforms.