The worldwide non permanent condo (STR) marketplace reached $201.6 billion in gross bookings in 2024, following atypical pandemic-era enlargement, in line with Phocuswright’s newest analysis record: World Brief-Time period Leases 2025. Whilst expansion is anticipated to average to unmarried digits in 2025, the sphere stays a structurally vital pressure in world accommodation—specifically in digitally-connected and leisure-driven segments.

Marketplace dynamics and regional divergence

Enlargement trajectories throughout world areas are increasingly more asymmetric. North The united states and Europe proceed to command the biggest proportion of STR bookings however are appearing indicators of adulthood. By contrast, rising areas are riding the following wave of enlargement. Asia Pacific has regained momentum following China’s complete reopening, whilst Latin The united states is experiencing fast positive aspects. Early signs additionally recommend emerging task within the Heart East and Africa.

Subscribe to our publication beneath

Virtual adoption and distribution shifts

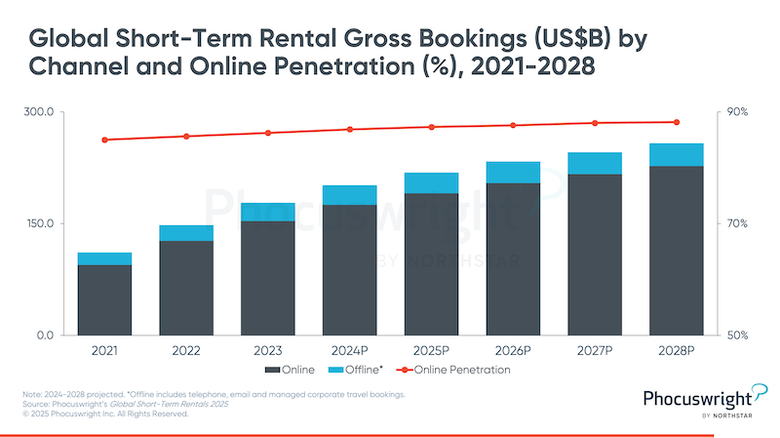

On-line channels stay the dominant engine of STR distribution. In 2024, on-line bookings accounted for 87% of general gross bookings, with that proportion projected to extend reasonably via 2028. This persisted virtual integration underscores how embedded STRs have develop into within the broader on-line go back and forth ecosystem.

Strategic pressures and aggressive shifts

Operators and platforms face rising exterior and interior pressures. Regulatory scrutiny is intensifying, specifically in city markets, and aggressive dynamics are evolving as lodge manufacturers increase their STR choices. Projects like Flats through Marriott Bonvoy have moved from pilot segment to strategic expansion mode, signaling a brand new segment of cross-category festival.

Traveler habits and insist patterns

Moving go back and forth patterns proceed to want the versatility and diversity STRs be offering. Regional go back and forth, prolonged remains and lifestyle-oriented accommodation stay in call for, even though long-haul corridors—specifically in Asia and choose rising markets—face headwinds from macroeconomic volatility and operational friction corresponding to visa processing delays.

Conclusion

The STR panorama is coming into a extra advanced, globally fragmented segment. As expansion slows in mature markets and speeds up in other places, strategic readability is very important.

Phocuswright’s World Brief-Time period Leases 2025

This record delivers complete sizing, forecasts and research through area and distribution channel—equipping go back and forth executives with the intelligence had to assess alternative, mitigate chance and adapt to ongoing alternate.

The worldwide non permanent condo (STR) marketplace reached $201.6 billion in gross bookings in 2024, following atypical pandemic-era enlargement, in line with Phocuswright’s newest analysis record: World Brief-Time period Leases 2025. Whilst expansion is anticipated to average to unmarried digits in 2025, the sphere stays a structurally vital pressure in world accommodation—specifically in digitally-connected and leisure-driven segments.

Marketplace dynamics and regional divergence

Enlargement trajectories throughout world areas are increasingly more asymmetric. North The united states and Europe proceed to command the biggest proportion of STR bookings however are appearing indicators of adulthood. By contrast, rising areas are riding the following wave of enlargement. Asia Pacific has regained momentum following China’s complete reopening, whilst Latin The united states is experiencing fast positive aspects. Early signs additionally recommend emerging task within the Heart East and Africa.

Subscribe to our publication beneath

Virtual adoption and distribution shifts

On-line channels stay the dominant engine of STR distribution. In 2024, on-line bookings accounted for 87% of general gross bookings, with that proportion projected to extend reasonably via 2028. This persisted virtual integration underscores how embedded STRs have develop into within the broader on-line go back and forth ecosystem.

Strategic pressures and aggressive shifts

Operators and platforms face rising exterior and interior pressures. Regulatory scrutiny is intensifying, specifically in city markets, and aggressive dynamics are evolving as lodge manufacturers increase their STR choices. Projects like Flats through Marriott Bonvoy have moved from pilot segment to strategic expansion mode, signaling a brand new segment of cross-category festival.

Traveler habits and insist patterns

Moving go back and forth patterns proceed to want the versatility and diversity STRs be offering. Regional go back and forth, prolonged remains and lifestyle-oriented accommodation stay in call for, even though long-haul corridors—specifically in Asia and choose rising markets—face headwinds from macroeconomic volatility and operational friction corresponding to visa processing delays.

Conclusion

The STR panorama is coming into a extra advanced, globally fragmented segment. As expansion slows in mature markets and speeds up in other places, strategic readability is very important.

Phocuswright’s World Brief-Time period Leases 2025

This record delivers complete sizing, forecasts and research through area and distribution channel—equipping go back and forth executives with the intelligence had to assess alternative, mitigate chance and adapt to ongoing alternate.