Discovering the cash for trip is among the largest demanding situations other folks face relating to taking a commute. It may take years to save lots of up for that dream commute!

And, when other folks in any case save up sufficient and hit the street, what do maximum of them finally end up doing?

They throw cash away on avoidable financial institution charges!!

Banking out of the country is extra than simply hanging your card in an ATM and disposing of cash. While you trip on the cheap, it comes to understanding tips on how to steer clear of financial institution charges, change price consequences, and making your cash give you the results you want.

I do know too many of us who trip in a foreign country and finally end up paying obscene financial institution charges after they trip.

And, nowadays, there’s completely no want to do this. You didn’t save up all this cash as a way to give it to the banks, proper? I do know I didn’t. I wish to stay it focused on myself as a result of each and every have shyed away from commission is more cash for meals, beverages, and actions at the street!

Here’s the way you do away with ALL financial institution charges while you trip in 5 simple steps:

1. Do away with ATM Charges

ATM charges can truly upload up — particularly should you’re touring for weeks or months at a time. Let’s consider it: when you’re at the street, you may withdraw cash from an ATM two times per week. When you withdraw cash from a global ATM together with your common debit card, you’ll be hit with 3 other charges:

- Your financial institution’s commission for the use of an ATM outdoor in their community (generally $2.50–5 USD)

- The ATM’s commission (generally $3–5 USD)

- A global conversion commission (generally 1–3% of the transaction)

As you’ll see, those charges in no time upload up. Charges range all over the world, however let’s say that you find yourself paying round $7 USD according to withdrawal. This is $14 a week, $56 per thirty days, or $672 according to 12 months! Are you aware what number of days you have to spend in Southeast Asia for that quantity? Virtually 3 weeks!

Although you handiest use the ATM as soon as per week, that’s nonetheless $364 USD according to 12 months. And maximum vacationers I do know move to the ATM much more than two times per week, which handiest will increase the quantity in charges they pay. Why give banks cash you wish to have for trip? You labored arduous saving your cash — don’t waste it by way of giving it to a financial institution.

That will help you steer clear of charges, listed below are 4 stuff you’ll wish to do to your subsequent commute to do away with the ones pesky charges:

First, you have to sign up for a financial institution that is a part of the World ATM alliance, the fundamental world banking community. The banks indexed beneath have agreements with one any other during which should you belong to at least one financial institution, you’ll use the ATMs of all of the different banks with out being charged an ATM commission:

- Financial institution of The usa

- Barclay’s

- BNP Paribas

- Deutsche Financial institution

- Scotiabank

- Westpac

Observe: Financial institution of The usa fees a three% transaction commission on all non-USD foreign money withdrawals, even for banks throughout the alliance. (Tip: Frequently, should you name Financial institution of The usa, they’ll refund maximum or all of this transaction commission.)

Past those banks, person alliance contributors have further partnerships. For instance, Financial institution of The usa additionally waives ATM charges with TEB in Turkey, UkrSibbank in Ukraine, and China Building Financial institution in China. And Westpac has an settlement with CIMB, a financial institution in Indonesia and Malaysia.

It’s necessary to notice that some nation subsidiaries of the above banks is probably not integrated within the ATM Alliance. For instance, if in case you have Financial institution of The usa, the BNP Paribas waiver handiest works for its France operation (no longer the rest) whilst Westpac handiest works in Australia and New Zealand however no longer Fiji.

However, for my part, the most efficient U.S. financial institution is Charles Schwab. Whilst Charles Schwab doesn’t have offers with any banks out of the country like the ones discussed above, they don’t fee any ATM charges and can reimburse any ATM charges from different establishments on the finish of each and every month. It is very important open a person bank account to qualify, however there is not any minimal deposit required and no per thirty days provider commission.

You’ll by no means pay a commission with Charles Schwab, and their ATM card can be utilized in any financial institution gadget all over the world. If there isn’t a department close to you, you’ll open an account on-line by way of going to their site. To me, that is the present BEST ATM card to have. I by no means, ever consider charges on account of it.

Listed here are some prompt ATM playing cards for non-US vacationers:

- Canada: Scotia and Tangerine are each a part of the World ATM Alliance.

- Australia: ING, Citibank, or HSBC haven’t any commission playing cards.

- UK: Starling allows you to steer clear of ATM charges in a foreign country. Monzo has fee-free world transactions in your first 200 GBP withdrawn each and every 30 days.

2. Keep away from Credit score Card Charges

The following main commission we want to eliminate is the bank card international transaction commission. Many bank cards fee a three% commission on purchases made out of the country. That may upload up since maximum people use our bank card for the whole lot. It’s turn into much more not unusual for bank cards to have “no international transaction charges” so it’s not going you’ll have a card that does however you’ll want to ask.

My favourite no out of the country transaction commission playing cards are the Chase Sapphire Most well-liked, Capital One, and Citi Premier, however there are heaps and heaps of choices and also you must select the cardboard that no longer handiest doesn’t have a commission however is excellent for incomes issues too.

For extra tips on bank cards, together with preferrred present provides, you’ll in finding all my favourite trip playing cards right here.

For non-US electorate, take a look at the next web sites that record playing cards that would possibly no longer fee any out of the country charges:

3. Reduce the Alternate Charge “Penalty”

Each time you employ your card out of the country, your native financial institution converts the transaction into your native foreign money for billing functions and takes somewhat off the highest for doing so. Thus, the legitimate price you spot on-line isn’t what you in reality get. That’s the interbank price and, until you turn into a big financial institution, you’re no longer going to get that price. All we will do is get as shut to that price as imaginable. To take action, you wish to have to:

Use a bank card -Bank card firms get the most efficient charges. The use of a bank card gets you an change price closest to the legitimate interbank foreign money price so steer clear of an ATM or money if you’ll.

Use an ATM – ATMs be offering the most efficient change price after bank cards. They aren’t as excellent as bank cards since industrial banks take somewhat extra off the highest, nevertheless it’s a lot better than exchanging money. Cash change workplaces be offering the worst charges as a result of they’re to this point down the meals chain, they may be able to’t get the most efficient change price (plus, they generally fee a fee as neatly).

Don’t use ATMs in bizarre places – The use of the ones ATMs you in finding in lodges, hostels, native 7-11s, or every other random position is a foul thought. They’re handy, however you’ll pay for that comfort. They at all times fee excessive ATM charges and be offering terrible conversion charges. Skip the ones ATMs and discover a main financial institution.

4. Don’t Alternate Cash at Airports

Maximum change bureaus in airports are to this point down the monetary meals chain they don’t have the clout to supply excellent change charges. The charges you spot at airports are the worst — by no means, ever use an change bureau there until you completely need to.

Any other tip: steer clear of the use of the corporate Travelex in any respect prices. They have got the worst charges and charges. By no means, by no means use them. Keep away from their ATMs too!

5. At all times Pick out the Native Forex

While you use your bank card in a foreign country, you’re going to continuously be given the strategy to be charged in your house foreign money (i.e., as an alternative of being charged in euros, they’ll fee you in US bucks). By no means say sure. The velocity at which they’re changing the foreign money is at all times worse than the speed your financial institution offers you.

Pick out the native foreign money and let your bank card corporate make the conversion. You’ll get a greater price and avoid wasting cash within the procedure.

6. Don’t Get Forex at House (and Skip Overseas Forex Playing cards!)

Whilst purchasing foreign money at house would possibly appear to be a good suggestion, you’ll finally end up getting a worse change price. Except you’re 100% certain you’ll want money proper on arrival, steer clear of exchanging cash in your house nation.

Airports all have ATMs the place you’ll withdraw cash should you desperately want it. (On the other hand, I recommend you wait till you get for your vacation spot and withdraw cash downtown/from an ATM clear of the airport. You’ll get a a lot better price and pay a far decrease commission. Use your bank card on arrival after which get money later.)

Moreover, steer clear of any “foreign currency echange playing cards” the place you’ll pre-load cash and lock within the change price. Turns out like a good suggestion, proper? Mistaken! You’re mainly seeking to expect the change price and having a bet you’ll beat the marketplace. You’re announcing this price isn’t going to worsen, however what if it will get higher? You don’t know! (And, should you do know, you must be putting bets out there.) Additionally, those playing cards include numerous charges that don’t lead them to value it. Simply steer clear of them.

Bonus: Make Your Cash Paintings For You

Stored a host of cash in your commute? Have it earn more money! Rates of interest are round 4% at this time so you’ll have your cash earn one thing when you’re away. It’s no longer such as you withdraw it abruptly, proper? I stay my cash in a high-yield financial savings account slightly than in a large financial institution! Here’s a record of one of the present best yields you’ll get:

Be good and financial institution good. I haven’t paid a financial institution commission whilst touring the arena in over fifteen years and also you shouldn’t both.

And, with those easy guidelines, you’ll by no means need to once more.

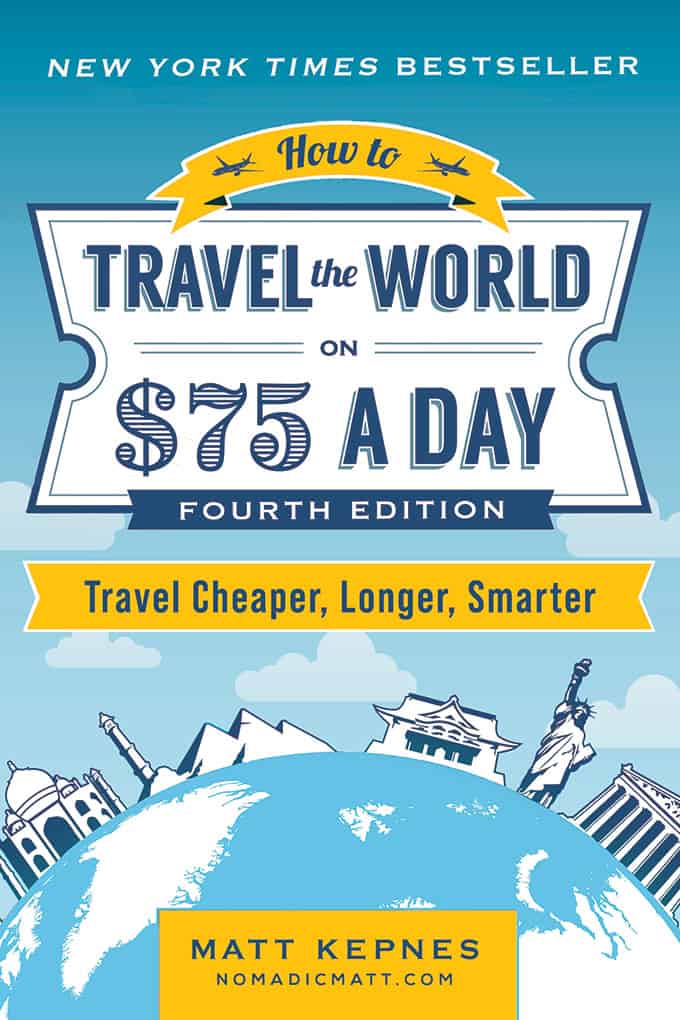

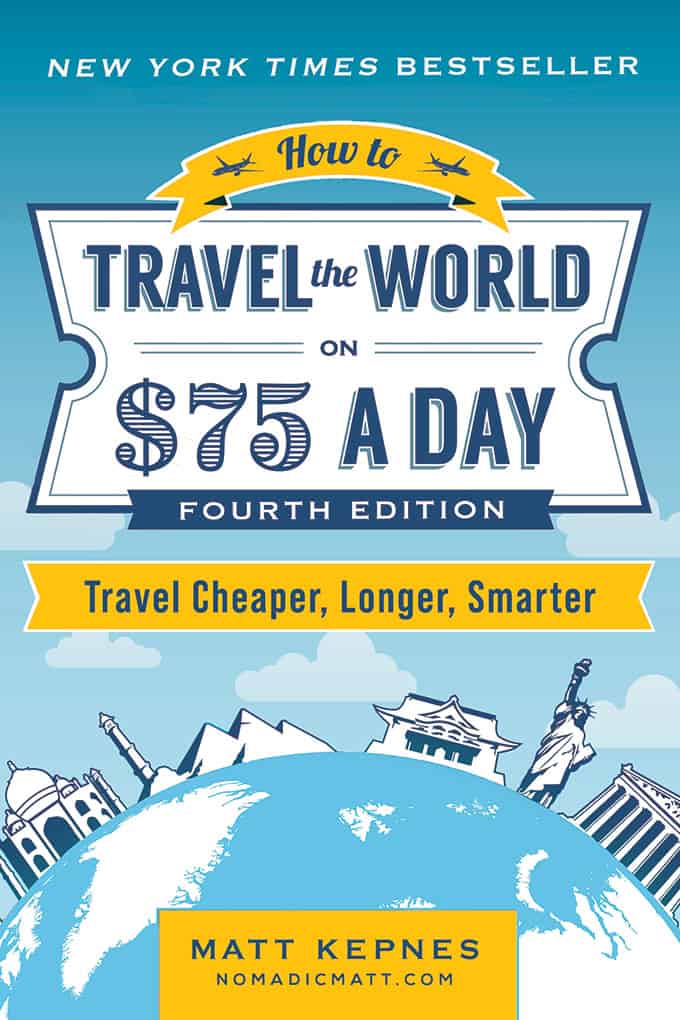

Find out how to Go back and forth the Global on $75 a Day

My New York Instances best-selling e book to trip will train you tips on how to grasp the artwork of trip in order that you’ll get off lower your expenses, at all times in finding offers, and feature a deeper trip revel in. It’s your A to Z making plans information that the BBC referred to as the “bible for funds vacationers.”

Click on right here to be informed extra and get started studying it nowadays!

Ebook Your Go back and forth: Logistical Guidelines and Tips

Ebook Your Flight

Discover a affordable flight by way of the use of Skyscanner. It’s my favourite seek engine as it searches web sites and airways around the world so that you at all times know no stone is being left unturned.

Ebook Your Lodging

You’ll e book your hostel with Hostelworld. If you wish to keep someplace rather then a hostel, use Reserving.com because it constantly returns the most affordable charges for guesthouses and lodges.

Don’t Fail to remember Go back and forth Insurance coverage

Go back and forth insurance coverage will offer protection to you in opposition to sickness, damage, robbery, and cancellations. It’s complete coverage in case the rest is going fallacious. I by no means move on a commute with out it as I’ve had to make use of it repeatedly prior to now. My favourite firms that supply the most efficient provider and price are:

Wish to Go back and forth for Unfastened?

Go back and forth bank cards permit you to earn issues that may be redeemed without cost flights and lodging — all with none further spending. Take a look at my information to choosing the right card and my present favorites to get began and notice the most recent preferrred offers.

Desire a Apartment Automotive?

Uncover Vehicles is a budget-friendly world automotive apartment site. Regardless of the place you’re headed, they’ll have the ability to in finding the most efficient — and most cost-effective — apartment in your commute!

Want Assist Discovering Actions for Your Go back and forth?

Get Your Information is a large on-line market the place you’ll in finding cool strolling excursions, amusing tours, skip-the-line tickets, personal guides, and extra.

In a position to Ebook Your Go back and forth?

Take a look at my useful resource web page for the most efficient firms to make use of while you trip. I record all of the ones I exploit after I trip. They’re the most efficient at school and you’ll’t move fallacious the use of them to your commute.