China’s go back and forth marketplace complicated 5.5% in 2024 to achieve $151.8 billion, a slower tempo than many anticipated. In step with Phocuswright’s analysis record China Shuttle Marketplace Necessities 2025, the expansion highlights each the size of call for and the continued demanding situations of restoring pre-pandemic momentum. In spite of greater than 5.6 billion home journeys, oversupply and subdued financial self assurance saved fares and charges from emerging.

The construction of the marketplace is unique. Home providers keep watch over rail, automobile apartment, on-line go back and forth businesses (OTAs) and far of the resort sector, whilst 3 state-backed airline teams proceed to dominate the skies. World resort manufacturers are increasing in main towns and starting to achieve lower-tier markets, whilst Chinese language chains nonetheless cling the benefit in finances and mid-range houses.

Subscribe to our e-newsletter underneath

Outbound go back and forth is strengthening, led by means of prosperous and impartial vacationers. Even supposing volumes is not going to go back to 2019 ranges till 2026, outbound journeys are projected to surpass the 155 million benchmark in 2025. Rail and self-drive go back and forth are flourishing, workforce excursions are changing into leaner and extra adapted and industry go back and forth is constrained by means of tighter company budgets.

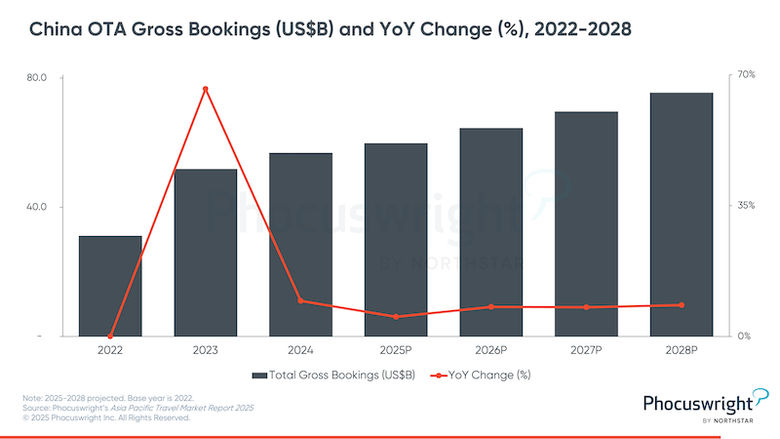

OTAs like Ctrip, Fliggy, Tongcheng, Meituan and Tuniu have invested massive sums in proprietary synthetic intelligence engineering and information science, expanded their buyer acquisition methods and reframed their club methods with aspirational rewards and incentives. Along with launching excursion merchandise for goal demographics like solo vacationers, seniors and graduates, OTAs are increasing their offline retailer networks in lower-tier towns to develop their gross sales channels and buyer bases. Since China reopened in 2023, OTAs had been notable beneficiaries.

Phocuswright’s China Shuttle Marketplace Necessities 2025

Free up the total image of China’s complicated go back and forth marketplace in Phocuswright’s China Shuttle Marketplace Necessities 2025. This new Necessities structure delivers top-level takeaways, whole with charts and research at the tendencies, phase highlights and marketplace sizing datapoints that subject maximum.

China’s go back and forth marketplace complicated 5.5% in 2024 to achieve $151.8 billion, a slower tempo than many anticipated. In step with Phocuswright’s analysis record China Shuttle Marketplace Necessities 2025, the expansion highlights each the size of call for and the continued demanding situations of restoring pre-pandemic momentum. In spite of greater than 5.6 billion home journeys, oversupply and subdued financial self assurance saved fares and charges from emerging.

The construction of the marketplace is unique. Home providers keep watch over rail, automobile apartment, on-line go back and forth businesses (OTAs) and far of the resort sector, whilst 3 state-backed airline teams proceed to dominate the skies. World resort manufacturers are increasing in main towns and starting to achieve lower-tier markets, whilst Chinese language chains nonetheless cling the benefit in finances and mid-range houses.

Subscribe to our e-newsletter underneath

Outbound go back and forth is strengthening, led by means of prosperous and impartial vacationers. Even supposing volumes is not going to go back to 2019 ranges till 2026, outbound journeys are projected to surpass the 155 million benchmark in 2025. Rail and self-drive go back and forth are flourishing, workforce excursions are changing into leaner and extra adapted and industry go back and forth is constrained by means of tighter company budgets.

OTAs like Ctrip, Fliggy, Tongcheng, Meituan and Tuniu have invested massive sums in proprietary synthetic intelligence engineering and information science, expanded their buyer acquisition methods and reframed their club methods with aspirational rewards and incentives. Along with launching excursion merchandise for goal demographics like solo vacationers, seniors and graduates, OTAs are increasing their offline retailer networks in lower-tier towns to develop their gross sales channels and buyer bases. Since China reopened in 2023, OTAs had been notable beneficiaries.

Phocuswright’s China Shuttle Marketplace Necessities 2025

Free up the total image of China’s complicated go back and forth marketplace in Phocuswright’s China Shuttle Marketplace Necessities 2025. This new Necessities structure delivers top-level takeaways, whole with charts and research at the tendencies, phase highlights and marketplace sizing datapoints that subject maximum.