The Walt Disney Corporate has shared govt repayment applications for present CEO Bob Iger, in addition to the CFO and others within the present c-suite. This submit takes a have a look at the ones numbers, Disney’s reason behind the salaries & bonuses, in addition to the most recent at the succession making plans procedure and the yearly shareholder’s assembly.

It’s now been over two years since Bob Iger reentered the construction as CEO of the Walt Disney Corporate, after the Board of Administrators pulled off a vintage Bob Change™️, changing Chapek with as soon as former and now present CEO Bob Iger. The collection of occasions culminating in that pivotal second remains to be being pieced in combination, as a part of our by some means still-ongoing Fight of the Bobs sequence. A minimum of one e-book at the matter is perhaps launched this 12 months. We will be able to’t wait.

In his letter to shareholders, Iger mentioned how Disney has emerged from a duration of substantial demanding situations neatly located for enlargement and constructive concerning the long run. He touted how Disney had “reinvigorated our movie studios, that are working with renewed ingenious power.” Disney ranked primary on the world field place of job in 2024 with a $5.46 billion slate (the primary time any studio eclipsed $5 billion since 2019) that incorporated Inside of Out 2 and Deadpool & Wolverine, either one of which set information. Disney additionally carried out neatly in TV, profitable quite a few accolades, together with a record-breaking 60 Emmy Awards. Disney+ additionally continues to develop, with greater than 120 million subscribers and profitability for the primary time ever.

In fact, you’re more than likely right here for Parks & Inns, so right here’s what Iger stated about that trade phase in his letter:

Our Reports companies stay the gold usual for the trade, and we’re assured within the phase’s long-term potentialities and dedicated to making an investment to force persevered long-term enlargement. Our footprint continues to develop with more than one tasks and expansions lately underway at our parks all over the world. We also are increasing Disney Cruise Line, permitting us to convey our maximum liked IP into markets the place we don’t have theme parks. This previous 12 months we debuted a brand new island vacation spot — Lighthouse Level — and we just lately introduced our newest send — the Disney Treasure — in December. As well as, our collaboration with Epic Video games will convey in combination Disney’s liked manufacturers and franchises in a transformational new video games and leisure universe.

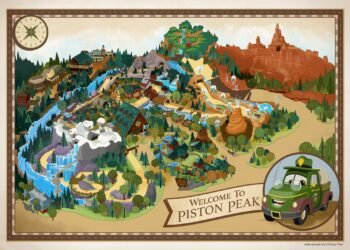

Most likely what’s extra noteworthy here’s what was once no longer stated. No point out of Walt Disney International, Disneyland–or any theme park by way of title. It wasn’t precisely an extended letter, however ESPN was once known as out a number of instances. It’s no longer sudden that theme parks wouldn’t be touted, as not anything primary opened on the ones that Disney owns remaining 12 months (Delusion Springs isn’t Disney-owned) and not anything is on faucet for 2025 or 2026.

It feels just like the parks are going to tread water for the following couple of years, with not anything to force enlargement with the exception of the speculation {that a} “emerging tide lifts all ships” and in all probability perhaps discovering techniques to chop prices and build up income. Most definitely no longer precisely what theme park lovers wish to see occur. We’re nonetheless hopeful that Walt Disney International has some leisure surprises up its sleeves for the following two years, but it surely’s similarly more likely to be a time of rising pains.

Turning to govt repayment, CEO Bob Iger noticed his general repayment package deal surge in 2024 to a staggering $41.1 million, up from “simplest” $31.6 million within the earlier 12 months. For no matter it’s value, that’s nonetheless down from $45.9 million in fiscal 2021, his remaining complete 12 months of employment on the corporate ahead of returning to the helm remaining 12 months in a while after the brand new fiscal 12 months started. So I assume perhaps Bob’s a discount even at a fab $41 million?

Iger’s repayment is weighted in opposition to performance-based incentives, with simplest $1 million of the entire accounted for by way of his base wage (up from $865,385 within the earlier 12 months). About $18.3 million of his pay got here within the type of inventory awards, $12 million was once stock-option awards, $7.2 million in non-equity incentive plan repayment, and $2.1 million in different repayment, in line with the corporate’s proxy remark filed with the SEC.

Consistent with that very same SEC submitting, inventory awards are matter to functionality prerequisites which are valued in keeping with the likelihood that such goals shall be completed. Assuming, as a substitute, that the perfect degree of functionality prerequisites are completed by way of the Walt Disney Corporate’s inventory, Iger’s inventory award for fiscal 2024 may well be value up to $31.8 million–simply the inventory award–for a complete of over $50 million.

The purpose, even though, is that Iger’s repayment may just range and is extra performance-based now than it was once prior to now. That is not unusual of media executives, and why there were loopy headlines about Warner Bros CEO David Zaslav making $250 million in keeping with 12 months. He doesn’t in truth; that’s his most repayment if he hits inventory functionality goals.

Zaslav gained’t achieve this as a result of he sucks and there’s no manner he’s going to greater than triple the present proportion worth, which is what could be had to earn ~$200 million of his theoretical pay. This isn’t to protect the $50 million Zaslav in truth makes–he isn’t value even that–however slightly, to protect correct reporting.

Disney’s SEC Proxy Remark additionally signifies that CFO Hugh Johnston made $24.5 million remaining 12 months (an important build up over his predecessors); Normal Suggest Horacio Gutierrez earned $15.8 million; HR head Sonia Coleman earned $7.6 million; and comms leader Kristina Schake earned $6.4 million. The entire senior c-suite noticed pay raises.

In keeping with SEC laws, Disney supplies the ratio of the yearly general repayment of its Leader Govt Officer to the yearly general repayment of Disney’s median worker. The ratio is a cheap estimate calculated in a way in line with SEC laws and the method described beneath.

To decide this, Disney evaluations the yearly base wage of the worldwide staff. Because of inhabitants measurement, the corporate identifies a band of staff with a base wage that approximates the median base wage amongst staff. The corporate calculates the median worker’s general annual repayment for fiscal 2024 (base wage, extra time pay, and the corporate’s contribution to medical health insurance premiums), and the median worker’s repayment didn’t include distortive repayment options.

The median Disney worker works in a full-time hourly function in parks and has been with the Corporate for over seven years. For fiscal 2024, the median worker’s general annual repayment was once $55,111. Bob Iger’s general annual repayment was once $41,122,670. The ratio of those quantities was once 746:1. (That’s up from the former 12 months, when the ratio was once 595:1.)

That ratio is all the time eye-popping. That is more than likely going to be an unpopular opinion, however I don’t essentially have an issue with excessive repayment when the exec is obviously accountable for luck. When former Disney CEO Michael Eisner exercised inventory choices value $565 million within the past due Nineties, he was once arguably value each penny after turning the afflicted corporate round and construction it into an leisure behemoth. (Would Disney even exist as of late however for Michael Eisner and Frank Wells?!)

It’s truthful to mention that the corporate had a excellent 2024–or a minimum of a greater 12 months than 2023 or 2022, which was once an attractive low bar. On the similar time, it additionally feels just like the turnaround procedure is solely getting began. Now not simplest that, however that Iger is solving issues of his personal advent with streaming, ESPN, or even the output on the studios. (I’d love to assume that creativity is again on the fore in filmmaking, however I’d be extra reassured if the entire best performers weren’t all sequels.)

At this level, issues are going higher however the long run remains to be unsure for Disney. There are giant query marks about linear tv, ESPN, streaming, debt, and extra. No matter enlargement happens with the theme parks gained’t be an natural build up in call for, or even the 5-year plan is unsure.

For the reason that, I have a look at the ones median (and beneath!) Parks & Inns staff, specifically the frontline Solid Individuals, and will’t assist however assume that they had been those who had been the difference-makers. As soon as once more, Parks & Inns has saved chugging alongside and had a listing fiscal 12 months, even with not anything new opening. Solid Individuals at the frontlines, are doing the exhausting paintings and heavy lifting to make magical recollections and stay other people coming to the parks.

This weblog has many times advocated for upper pay for Solid Individuals. Once more, this isn’t an issue of seeking to ranking simple issues. It’s egocentric. High quality Solid Individuals who’re handled proper, really feel valued, and are unswerving to the corporate are a excellent factor for me, as a visitor who can see and really feel a distinction when Disney looks after its other people. Solid Individuals are the difference-makers, and the corporate making an investment in them is solely excellent trade.

I nearly ranted about this according to the scoop that Disney Cruise Line is expanding beneficial gratuities, however the matter of tipping is so fraught that it appeared more likely to be misinterpreted. (Off-topic, however I don’t assume companies must be offloading repayment choices to consumers, particularly ones with clientele in quite a lot of international locations with other cultural norms round tipping. Simply pay DCL Staff Individuals extra. They in point of fact are the gold usual of provider!)

As we pay attention extra lawsuits from readers about Solid Individuals, upper pay is the very glaring (a minimum of, to me) resolution. Firms don’t draw in and retain best skill with out aggressive wages. There are a large number of individuals who wish to paintings to make the magic for visitors and are keen to simply accept much less to do it, however that’s no longer the norm.

There’s a novel explanation why Disney has needed to decrease its hiring requirements, and that’s pay. To be transparent, Solid Individuals are most commonly superlative–however to no matter extent you may assume they’re no longer as pleasant, a professional, or no matter as they had been in 2019 or previous, the solutions to which are morale and cash (with a immediately line between the latter and previous).

A little bit of an apart, however this can be a massive a part of why I like In-N-Out Burger and Buc-ee’s. The circle of relatives and people who personal those firms are rich. Just right for them–they more than likely deserve it. Now not simply because they run nice companies, however as a result of they deal with their other people and that’s right away obvious within the buyer revel in. It’s an ‘everyone wins’ state of affairs–what’s to not love?!

Turning to succession making plans, Chairman of the Board James P. Gorman had this to mention in his letter to shareholders:

As we communicated all through the 12 months, the Board stays actively engaged within the high-priority paintings of leadership succession making plans. As Chair of the Succession Making plans Committee, I’m interested by managing our succession procedure, and we have now persevered to make sturdy growth during the last 12 months. In accordance with shareholder comments, I used to be happy to proportion an replace on our anticipated timing to announce a CEO successor in early 2026. The entire Board is engaged in and dedicated to discovering the best chief for the Corporate and we’re making plans for a clean management transition that may allow Disney’s persevered luck.

The Board additionally stays interested by efficient Corporate oversight, which contains common analysis and making plans to handle suitable Board illustration throughout a extensive and related set of talents and stories. 5 non-management Administrators, together with myself, have joined the Board since 2021, bringing further views and experience to this already top quality Board. We will be able to proceed to hunt sturdy alignment of our Board’s talents, views and backgrounds to supervise Disney’s strategic priorities.

To be totally transparent, I additionally (nonetheless) assume it’s a excellent factor that Bob Iger will proceed to function Leader Govt Officer thru December 31, 2026 and that the corporate will announce his successor in early 2026. He wishes the runway for succession making plans and to show issues round, and is best possible located at making that occurs from the viewpoint of revel in and experience. The just about year-long window between anointing the selected one and having them take the helm is more than likely savvy, as long as Iger doesn’t get 2d (3rd? fourth? 15th?) ideas about leaving.

Relating to the lengthy tail of succession making plans, it’s more than likely additionally value citing the management shake-up at Parks & Inns that simply came about, with Disneyland, Disney Cruise Line, and Shanghai Disneyland all getting new presidents. This really well may well be environment the desk for Josh D’Amaro’s inevitable departure–both to the CEO seat or outdoor the corporate if he’s handed over for a promotion–from the Reports Chairman function. It’ll be attention-grabbing to peer a front-runner emerge for that as a result of, from the outdoor taking a look in, nobody has in reality finished the rest to provoke.

Most likely we’ll be told extra right through the 2025 Annual Assembly of Shareholders of The Walt Disney Corporate, which shall be held nearly at

www.virtualshareholdermeeting.com/DIS2025. That assembly will happen on Thursday, March 20, 2025 at 10 a.m. Pacific.

In any case, for any individual who is obviously fixated on his legacy, I’m quite shocked Bob Iger has the sort of excessive repayment package deal. It could look like sooner or later, he’d have extra money than he can ever spend, and would possibly wish to believe the sure optics of being paid much less. Take a $1 wage–or take his precise wage however donate all of it to a couple Disney-adjacent charity if he needs the tax smash–and say you’re doing it for romance of the sport and to be sure that Disney has a powerful basis and is left in succesful arms.

If Bob Iger needs to cement his standing as the one that rebuilt Disney, that may well be the savvy transfer. Or in all probability no longer. Possibly Iger realizes that lovers will focal point on his wage for an afternoon or two, however overlook it inside every week regardless of if it’s $1 or $100 million. Those who dislike him will simply discover a other reason why to take action, and people who love him will likewise be lovers regardless. I don’t know. He’s so much smarter than me, so he’s more than likely regarded as this from each attitude.

Want Disney travel making plans guidelines and complete recommendation? Be sure to learn 2024 Disney Parks Holiday Making plans Guides, the place you’ll in finding complete guides to Walt Disney International, Disneyland, and past! For Disney updates, bargain data, unfastened downloads of our eBooks and wallpapers, and a lot more, join our FREE e mail publication!

YOUR THOUGHTS

What are your ideas on Bob Iger’s fiscal 2024 repayment and severance? Assume he’s “value” 746x the common Parks & Inns Solid Member? Do you compromise or disagree with our overview? Any questions we will be able to can help you resolution? Listening to your comments–even whilst you disagree with us–is each attention-grabbing to us and useful to different readers, so please proportion your ideas beneath within the feedback!