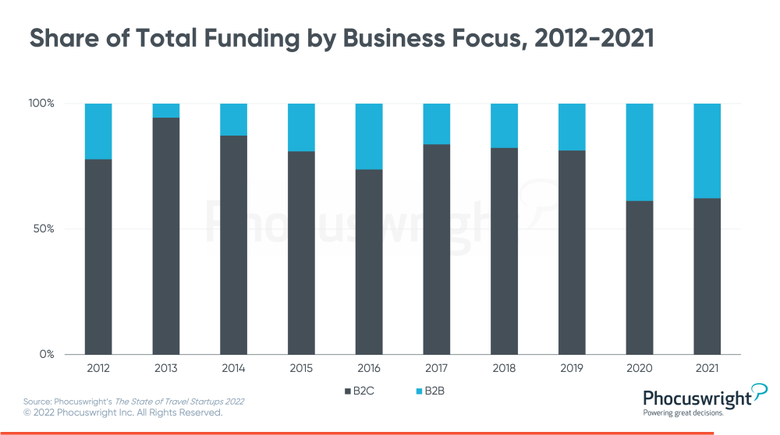

Investment to B2C shuttle startups at all times outpaces B2B

on account of the investments wanted for client companies to scale.

However the proportion of B2C as opposed to B2B investment tells an

attention-grabbing tale – it has trended towards B2B firms for years, and in 2021

B2B investment hit its perfect proportion ever, at 39% in line with Phocuswright’s

shuttle analysis file The State of Go back and forth

Startups 2022.

This used to be partially because of $3 billion going to the highest 4

city transportation firms in China, which all perform on a B2B foundation:

WeRide ($1.5 billion) HT Aero ($500 million), Deeproute ($500 million) and

Momenta ($500 million).

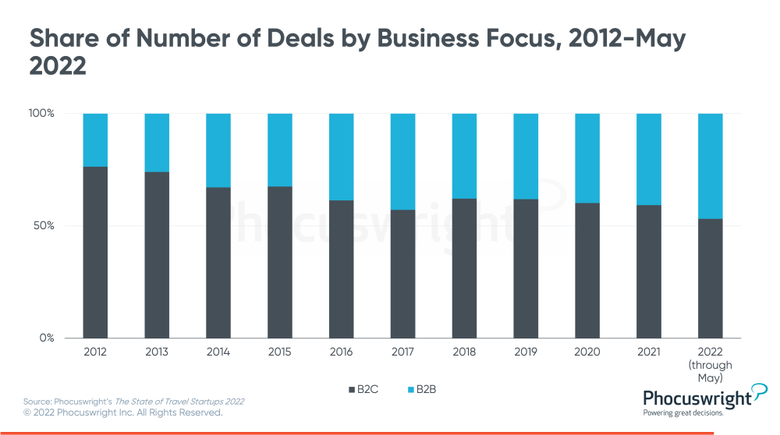

When it comes to the collection of offers, B2B continues to realize

proportion, even into 2022.

Despite the fact that B2B corporation income generally by no means reaches the

lofty heights of B2C juggernauts, their quite predictable, secure income

turned into a lot more horny to buyers right through the uncertainty of the

pandemic.

Moreover, B2B firms could have higher captured consideration from

doable shoppers and companions, as openness to generation use for greater

potency and automation greater in company boardrooms around the

global.

Moreover, scaling a B2C startup is handiest getting

more difficult: search engine marketing/PPC, social media and influencer campaigns have been low-hanging fruit

for smaller client firms, however all of them seem to be saturated now,

pricing out maximum smaller firms.

As well as, the sheer quantity of choices

produces a loud and distracting panorama, making it tougher for B2C

firms to chop thru and achieve the shopper. However, dozens of

systems and buyers have occupied with facilitating B2B startup introductions

and industry offers up to now decade, offering a supportive infrastructure

for B2B firms.

Get the total file!

verticals, horizontals, industry center of attention, areas and the outlook at the long run,

get Phocuswright’s The

State of Startups 2022. This file is

available to buy and incorporated in our Open Get admission to

subscription, which additionally provides company-wide get right of entry to to the entire library of

Phocuswright’s shuttle analysis and knowledge visualization.

Investment to B2C shuttle startups at all times outpaces B2B

on account of the investments wanted for client companies to scale.

However the proportion of B2C as opposed to B2B investment tells an

attention-grabbing tale – it has trended towards B2B firms for years, and in 2021

B2B investment hit its perfect proportion ever, at 39% in line with Phocuswright’s

shuttle analysis file The State of Go back and forth

Startups 2022.

This used to be partially because of $3 billion going to the highest 4

city transportation firms in China, which all perform on a B2B foundation:

WeRide ($1.5 billion) HT Aero ($500 million), Deeproute ($500 million) and

Momenta ($500 million).

When it comes to the collection of offers, B2B continues to realize

proportion, even into 2022.

Despite the fact that B2B corporation income generally by no means reaches the

lofty heights of B2C juggernauts, their quite predictable, secure income

turned into a lot more horny to buyers right through the uncertainty of the

pandemic.

Moreover, B2B firms could have higher captured consideration from

doable shoppers and companions, as openness to generation use for greater

potency and automation greater in company boardrooms around the

global.

Moreover, scaling a B2C startup is handiest getting

more difficult: search engine marketing/PPC, social media and influencer campaigns have been low-hanging fruit

for smaller client firms, however all of them seem to be saturated now,

pricing out maximum smaller firms.

As well as, the sheer quantity of choices

produces a loud and distracting panorama, making it tougher for B2C

firms to chop thru and achieve the shopper. However, dozens of

systems and buyers have occupied with facilitating B2B startup introductions

and industry offers up to now decade, offering a supportive infrastructure

for B2B firms.

Get the total file!

verticals, horizontals, industry center of attention, areas and the outlook at the long run,

get Phocuswright’s The

State of Startups 2022. This file is

available to buy and incorporated in our Open Get admission to

subscription, which additionally provides company-wide get right of entry to to the entire library of

Phocuswright’s shuttle analysis and knowledge visualization.