Australia and New Zealand’s (ANZ) shuttle trade has surpassed pre-pandemic earnings ranges, however the image in the back of the numbers tells a extra difficult tale. New analysis from Phocuswright’s Australia-New Zealand Trip Marketplace Transient 2025 displays that whilst gross earnings rose to $37.8 billion in 2024, the expansion is being pushed in large part by means of larger costs slightly than will increase in customer volumes.

Inflation, now not inflow

Home shuttle is already saturated, and inbound flight capability stays constrained. That implies restricted room for natural growth, whilst airways, resorts and automobile condominium companies record larger takings. Business watchers warn that the sphere’s reliance on inflationary positive aspects leaves it uncovered if client spending softens.

Governments in each Australia and New Zealand are leaning into a technique of attracting higher-spending guests, a transfer designed to strengthen sustainability however one who places added drive on providers to ship top class price.

On-line channels hit a ceiling

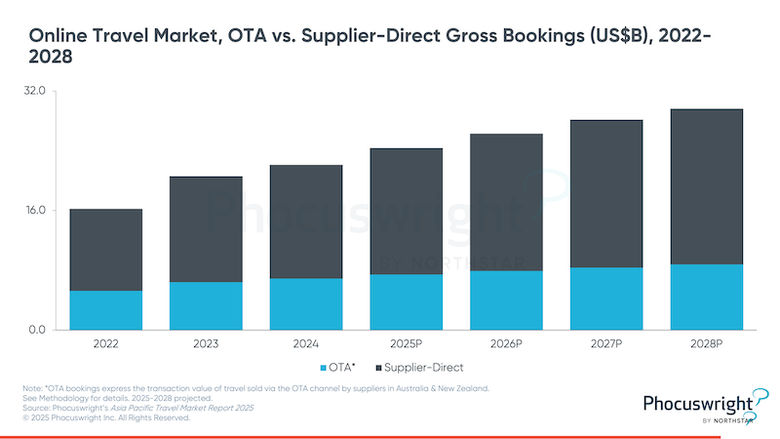

Virtual adoption within the ANZ shuttle marketplace is as regards to adulthood, with on-line penetration hitting 59% in 2024 and forecast to succeed in simply 61% by means of 2028. Whilst on-line shuttle businesses (OTAs) keep growing, their growth is being outpaced by means of supplier-direct channels.

Main avid gamers—from the duopoly of Qantas and Virgin in Australia to Air New Zealand and hospitality massive Accor—are the usage of their assets and succeed in to stay extra bookings in-house. Conventional retail and company businesses, in the meantime, proceed to carry sway for advanced and high-value global journeys, additional slowing the momentum of intermediaries.

Airways poised for lift-off

Efficiency throughout shuttle segments stays asymmetric. Airways, regardless of setbacks together with the cave in of Rex and Bonza in 2024, are anticipated to energy enlargement from 2025 onward. Partnerships, similar to Qatar Airlines’ funding in Virgin Australia, mixed with larger fares and fuller planes, are forecast to power double-digit earnings positive aspects.

Resorts, against this, face a more difficult setting. Home vacationers are moving their spend in another country, and occupancy charges hover within the low 70% vary. Whilst the sphere holds really extensive stock, higher pageant is restraining enlargement. Automotive condominium, nonetheless getting better to pre-COVID ranges, is taking advantage of the stable go back of inbound vacationers and the area’s dependence on self-drive mobility.

What it method

The ANZ shuttle marketplace is rising however now not in ways in which counsel a right away growth. Value will increase, slightly than customer numbers, are propping up earnings. Distribution is tilting towards supplier-direct, proscribing positive aspects for OTAs. And whilst airways seem set to guide the following enlargement cycle, resorts and automobile condominium firms face a tougher trail.

For shuttle firms, the sign is obvious: Luck will hinge much less on chasing quantity and extra on competing for high-value consumers, strengthening direct relationships and aligning methods with the strongest-performing sectors.

Phocuswright’s Australia-New Zealand Trip Marketplace Transient 2025

To dig deeper into those findings—together with marketplace sizing, projections thru 2028 and segment-by-segment efficiency throughout airways, resorts, automobile condominium and extra—believe subscribing to Phocuswright Open Get right of entry to.

Australia and New Zealand’s (ANZ) shuttle trade has surpassed pre-pandemic earnings ranges, however the image in the back of the numbers tells a extra difficult tale. New analysis from Phocuswright’s Australia-New Zealand Trip Marketplace Transient 2025 displays that whilst gross earnings rose to $37.8 billion in 2024, the expansion is being pushed in large part by means of larger costs slightly than will increase in customer volumes.

Inflation, now not inflow

Home shuttle is already saturated, and inbound flight capability stays constrained. That implies restricted room for natural growth, whilst airways, resorts and automobile condominium companies record larger takings. Business watchers warn that the sphere’s reliance on inflationary positive aspects leaves it uncovered if client spending softens.

Governments in each Australia and New Zealand are leaning into a technique of attracting higher-spending guests, a transfer designed to strengthen sustainability however one who places added drive on providers to ship top class price.

On-line channels hit a ceiling

Virtual adoption within the ANZ shuttle marketplace is as regards to adulthood, with on-line penetration hitting 59% in 2024 and forecast to succeed in simply 61% by means of 2028. Whilst on-line shuttle businesses (OTAs) keep growing, their growth is being outpaced by means of supplier-direct channels.

Main avid gamers—from the duopoly of Qantas and Virgin in Australia to Air New Zealand and hospitality massive Accor—are the usage of their assets and succeed in to stay extra bookings in-house. Conventional retail and company businesses, in the meantime, proceed to carry sway for advanced and high-value global journeys, additional slowing the momentum of intermediaries.

Airways poised for lift-off

Efficiency throughout shuttle segments stays asymmetric. Airways, regardless of setbacks together with the cave in of Rex and Bonza in 2024, are anticipated to energy enlargement from 2025 onward. Partnerships, similar to Qatar Airlines’ funding in Virgin Australia, mixed with larger fares and fuller planes, are forecast to power double-digit earnings positive aspects.

Resorts, against this, face a more difficult setting. Home vacationers are moving their spend in another country, and occupancy charges hover within the low 70% vary. Whilst the sphere holds really extensive stock, higher pageant is restraining enlargement. Automotive condominium, nonetheless getting better to pre-COVID ranges, is taking advantage of the stable go back of inbound vacationers and the area’s dependence on self-drive mobility.

What it method

The ANZ shuttle marketplace is rising however now not in ways in which counsel a right away growth. Value will increase, slightly than customer numbers, are propping up earnings. Distribution is tilting towards supplier-direct, proscribing positive aspects for OTAs. And whilst airways seem set to guide the following enlargement cycle, resorts and automobile condominium firms face a tougher trail.

For shuttle firms, the sign is obvious: Luck will hinge much less on chasing quantity and extra on competing for high-value consumers, strengthening direct relationships and aligning methods with the strongest-performing sectors.

Phocuswright’s Australia-New Zealand Trip Marketplace Transient 2025

To dig deeper into those findings—together with marketplace sizing, projections thru 2028 and segment-by-segment efficiency throughout airways, resorts, automobile condominium and extra—believe subscribing to Phocuswright Open Get right of entry to.