Whilst inflation and financial uncertainty are a few of the best demanding situations dealing with U.S. trip businesses, the marketplace stays robust.

Regardless of slower projected enlargement in 2025 in comparison to the former 12 months, trip company gross sales are outpacing the total trip marketplace, with unique and high-end luxurious trip main positive factors, consistent with Phocuswright’s fresh trip analysis record, U.S. Commute Company Panorama 2025. Wealthier vacationers, undeterred by means of upper costs, proceed to hunt out distinctive studies and the non-public provider trip advisors be offering. Even supposing U.S. vacationers total are appearing heightened worth sensitivity, advisors are leveraging numerous ways to attraction to extra budget-conscious consumers.

The customer profile of U.S. trip brokers

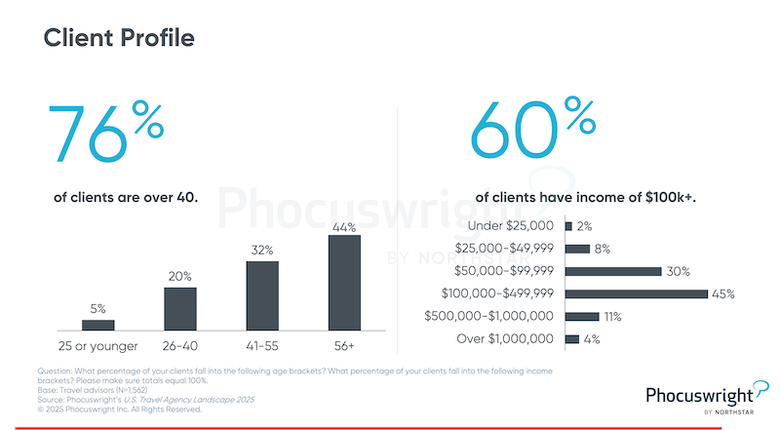

Vacationers who paintings with advisors are in most cases older and wealthier than the common traveler. Greater than 3 quarters of shoppers are over 40 years outdated, with 44% older than 55. Six in 10 shoppers have an annual source of revenue of $100,000 or extra.

More youthful vacationers, with a powerful pressure to trip, are frequently a key demographic within the broader trip marketplace. Alternatively, they have a tendency to be extra value wakeful, frequently leveraging on-line trip businesses to search out the bottom worth. But interesting to more youthful generations is a very powerful for the long-term luck of the consultant channel. There may be larger center of attention on attracting and coaching Gen Z and millennial advisors with a big social media presence to higher interact with more youthful vacationers.

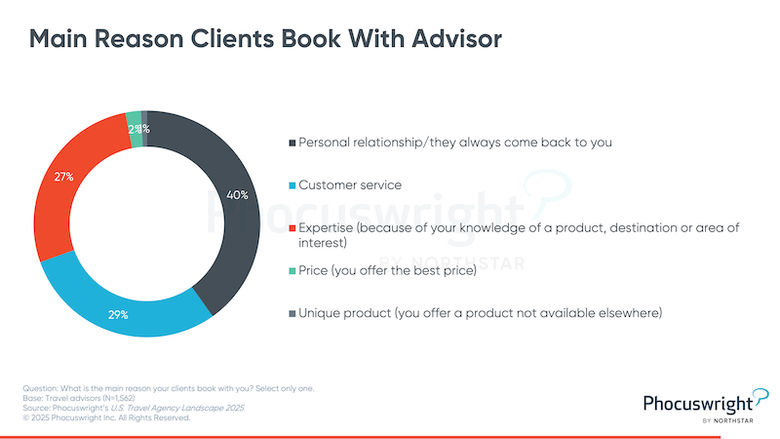

Whilst more youthful vacationers frequently select their reserving channel in keeping with worth, advisors point out that handiest 2% in their shoppers guide with them as a result of they provide the most productive worth. As a substitute, advisors say non-public relationships, customer support and their wisdom of trip merchandise and locations are maximum necessary to attracting vacationers.

Increasing the customer base to incorporate a more youthful clientele would require teaching more youthful vacationers about the advantages that advisors can give—and doing so in some way that may attraction to this more youthful demographic.

U.S. Commute Company Panorama 2025

U.S. Commute Company Panorama 2025 is a part of a joint analysis mission with Phocuswright and Commute Weekly, monitoring the trip company distribution panorama and total marketplace dimension.

Whilst inflation and financial uncertainty are a few of the best demanding situations dealing with U.S. trip businesses, the marketplace stays robust.

Regardless of slower projected enlargement in 2025 in comparison to the former 12 months, trip company gross sales are outpacing the total trip marketplace, with unique and high-end luxurious trip main positive factors, consistent with Phocuswright’s fresh trip analysis record, U.S. Commute Company Panorama 2025. Wealthier vacationers, undeterred by means of upper costs, proceed to hunt out distinctive studies and the non-public provider trip advisors be offering. Even supposing U.S. vacationers total are appearing heightened worth sensitivity, advisors are leveraging numerous ways to attraction to extra budget-conscious consumers.

The customer profile of U.S. trip brokers

Vacationers who paintings with advisors are in most cases older and wealthier than the common traveler. Greater than 3 quarters of shoppers are over 40 years outdated, with 44% older than 55. Six in 10 shoppers have an annual source of revenue of $100,000 or extra.

More youthful vacationers, with a powerful pressure to trip, are frequently a key demographic within the broader trip marketplace. Alternatively, they have a tendency to be extra value wakeful, frequently leveraging on-line trip businesses to search out the bottom worth. But interesting to more youthful generations is a very powerful for the long-term luck of the consultant channel. There may be larger center of attention on attracting and coaching Gen Z and millennial advisors with a big social media presence to higher interact with more youthful vacationers.

Whilst more youthful vacationers frequently select their reserving channel in keeping with worth, advisors point out that handiest 2% in their shoppers guide with them as a result of they provide the most productive worth. As a substitute, advisors say non-public relationships, customer support and their wisdom of trip merchandise and locations are maximum necessary to attracting vacationers.

Increasing the customer base to incorporate a more youthful clientele would require teaching more youthful vacationers about the advantages that advisors can give—and doing so in some way that may attraction to this more youthful demographic.

U.S. Commute Company Panorama 2025

U.S. Commute Company Panorama 2025 is a part of a joint analysis mission with Phocuswright and Commute Weekly, monitoring the trip company distribution panorama and total marketplace dimension.